The operating comments of the Board of Directors of Nanxin Technology in 2023 are as follows:

I. Discussion and analysis of business conditions

In 2023, influenced by macro factors such as weak terminal market and slow economic development, the global and even domestic semiconductor market is under great pressure. According to the data of the World Semiconductor Trade Statistics Organization (WSTS), the global semiconductor market scale is expected to decrease by 9.4% to 520.1 billion US dollars compared with the same period of last year. With the advantages of technological innovation, product research and development and customer barriers, the company enriched product categories and improved product layout, and achieved steady growth in performance during the reporting period.

During the reporting period, the company achieved an operating income of 1,780,402,300 yuan, an increase of 36.87% compared with last year; The net profit attributable to shareholders of listed companies was 261,357,500 yuan, an increase of 6.15% over the same period of last year; The gross profit margin of the main business was 42.30%, a decrease of 0.74 percentage points compared with the same period of last year.

At the end of the reporting period, the company’s total assets were 4,461,859,900 yuan, an increase of 93.63% over the end of the previous year; The net assets attributable to shareholders of listed companies were 3,699,036,800 yuan, an increase of 244.34% over the end of last year. In line with the profit distribution conditions, the company actively promotes the profit distribution to shareholders. In 2023, based on the total share capital of 423,530,000 shares, the company plans to distribute a cash dividend of 118,588 2.8 yuan (including tax) for every 10 shares, accounting for 45.37% of the net profit attributable to shareholders of listed companies in 2023.

(a) the overall operating condition is stable, and the performance in a single quarter continues to improve.

In the case of the overall market downturn, the company has continuously broadened its product layout around application scenarios and continuously introduced products with market competitiveness, and its performance has continued to improve. The company’s operating income in each quarter in 2023 was 285,668,200 yuan, 374,791,500 yuan, 545,396,400 yuan and 574,546,200 yuan respectively, and the annual performance maintained an overall upward trend. In 2023, the gross profit margin of the company’s main business was 42.30%, a decrease of 0.74 percentage points compared with 2022, and its profitability remained stable.

(B) Insist on increasing R&D investment and increasing the achievements of R&D teams.

During the reporting period, the company invested 292,517,100 yuan in R&D, an increase of 57.02% over the same period of last year; By the end of the reporting period, the number of R&D personnel in the company had increased to 378, an increase of 32.17% over the same period of last year, and the number of R&D personnel accounted for 65.40% of the company.

In 2023, the company obtained 29 new authorized invention patents, and accumulated 89 patents, all of which were invention patents. The company has added seven core technologies, all of which are independently developed, namely, lithium battery monitoring technology, zero-voltage switching charge pump control technology, low-voltage self-starting technology, secondary control fully integrated soft-switching Fyback technology, SmartHighSideDriver technology, automotive smart fuse technology and automotive antenna LDO technology, and all of the above technologies have been applied to the company’s products.

(3) Enrich product models and actively expand emerging application fields.

As one of the leading analog and embedded chip design companies in China, the company continuously improves product layout around application scenarios to provide customers with better end-to-end complete solutions. While deeply cultivating the original advantageous fields such as smart phones, the company is also actively expanding into the fields of automotive electronics and industrial applications.

1. Key investment in automotive electronics business, and significant progress has been made.

According to the data of China Association of Automobile Manufacturers, in 2023, China’s automobile production and sales reached 30.161 million and 30.094 million respectively, up by 11.6% and 12% respectively, and the annual production and sales both reached record highs. Benefiting from the growth of the automotive electronics market and several new automotive products, during the reporting period, the company achieved an operating income of 30,641,000 yuan in the field of automotive electronics applications, an increase of 89.02% over the same period of last year, and the products were introduced to many well-known head customers in the industry.

The company attaches great importance to the automotive electronics business, invests a lot of resources, and develops several projects at the same time. The company cut into the automobile head manufacturer from the vehicle-mounted wireless wired charging, and with the ability of rapid iteration and continuous innovation, it constantly expanded the layout of new categories, and carried out product layout planning in the fields of automobile instruments, intelligent cockpit, ADAS and BMS. During the reporting period, the company’s USB and wireless charging solutions were mass-produced at the client; High-performance DC-DC power chips, HSD chips, E-fuse chips and other new products have achieved scale sample delivery at the client, and some customers have entered the fixed-point design stage of the project.

2, the smart phone power management chip covers the whole link, so as to improve the single-machine value.

During the reporting period, the company’s mobile phone wired charging chip continued to introduce products with higher integration and higher performance, which can achieve a maximum fast charging power of 300W, further maintaining its leading position in the industry and helping customers further improve the charging power and experience of products.

Through the application scenario traction, the company improved the product layout of the overall charging link of smart phones during the reporting period, and achieved full coverage of wired charging, wireless charging, screen driver chips and lithium battery protection chips. With the help of wired charging chips, the company has reached a deep cooperative relationship with domestic mainstream mobile phone manufacturers, and actively promoted the introduction of other product lines in the field of mobile phones, improving the stand-alone value of the company’s products in mobile phones.

3. Enrich the product matrix and actively expand the industrial application market.

The company continues to enrich product categories and plans to achieve end-to-end product layout in the industrial field; Actively expand the market of products in industrial and other fields, and achieve certain results in the fields of energy storage, drones, power tools, communications, etc., and it is expected to be further introduced into industrial power supply, AIPower and other fields in the future.

(D) the construction of reliability laboratories, improve quality management.

The company attaches great importance to quality management and establishes a quality management system according to the requirements of TS16949. The product quality has been recognized and trusted by many well-known domestic terminal manufacturers. During the reporting period, the company successfully completed the highest level certification of ISO26262 functional safety management system -ASILD level certification, and the overall product quality system moved to a new level.

The company actively builds its own test center, and obtains instant, accurate and complete feedback data by customizing specialized test procedures for key nodes in the process of new product research and development, thus giving positive effects to product research and development to the maximum extent. In 2023, the company has completed the construction of the second phase of the reliability laboratory. With the second phase of the laboratory put into use, the company’s quality management ability will continue to gain.

(E) Perfect supply chain management to improve product competitiveness.

The company attaches great importance to the construction of supply chain capacity, seeks cooperation with leading manufacturers in the industrial chain in supplier selection, and has established efficient linkage mechanism and long-term stable cooperative relationship with suppliers such as upstream wafer manufacturers and packaging and testing manufacturers.

The company’s main wafer suppliers and main packaging and testing suppliers are mainly well-known enterprises in the industry. They not only have advanced production technology to ensure the yield and consistency of products, but also are local partners, which is conducive to the independent control of the company’s supply chain, which can effectively guarantee the company’s capacity supply and reduce the impact of capacity fluctuation on the timeliness of product delivery. At the same time, because the company tilts its production capacity to the head supplier and increases the demand for orders, it can gain a better price advantage. In addition, through strategic cooperation with upstream suppliers and the development of their own processes, the company can maintain the leading position of products in wafer manufacturing process and packaging process, and further improve the competitiveness of products.

(six) pay attention to personnel training and establish a long-term incentive system.

In the process of development, the company always regards talents as the core resources of the company, and does a good job in talent construction for the large-scale growth and long-term development of the company. In 2023, the company actively broadened the channels for introducing talents, efficiently integrated R&D resources, and continuously optimized the talent team. By the end of the reporting period, the company had a total of 578 employees, including 378 R&D personnel, accounting for 65.40% of the total number of employees, of which 55.56% were R&D personnel with master’s degree or above.

In order to promote the construction of talent echelon, the company pays attention to employee training, optimizes talent training scheme, improves the construction of talent training system, and standardizes internal training management and professional technology sharing and exchange system. During the reporting period, the company formulated the restricted stock incentive plan for 2023. Through the implementation of the restricted stock incentive plan, 8,701,394 restricted shares were granted for the first time, which fully mobilized the enthusiasm of the company’s employees and effectively combined the interests of shareholders, the company and employees, so that all parties concerned about the long-term development of the company.

II. Description of the company’s main business, business model, industry and R&D during the reporting period.

(a) the main business, main products or services.

Nanxin Technology is one of the leading analog and embedded chip design enterprises in China. Its main business is the research, development, design and sales of analog and embedded chips, focusing on the field of power supply and battery management, and providing customers with end-to-end complete solutions. The company’s existing products have covered mobile device power management chips (including line charging management chips, wireless charging management chips, lithium battery management chips, and other mobile device power management chips), general power management chips, adapter power management chips, and automotive electronic chips. By building a complete product matrix, it meets the application needs of customers’ systems.

With the business vision of "becoming the world’s leading analog and embedded chip enterprise", the company has launched high-performance power supply and battery management chips in the fields of consumer electronics, industry and automotive electronics with efficient research and development capabilities, excellent technological innovation capabilities and strict quality control capabilities, helping domestic chips to be self-controllable. The company has established an efficient linkage mechanism and long-term stable cooperative relationship with upstream wafer manufacturers, packaging and testing manufacturers and other suppliers, which has improved the company’s supply chain capability; The company has established an increasingly close partnership with terminal brand customers, kept abreast of the new direction and trends of demand-side technology in good cooperation, and conducted targeted R&D iterations on products, thus improving R&D efficiency. In the future, the company will continue to strengthen technology accumulation, increase R&D investment, continue to iteratively upgrade existing products, continuously enrich the product matrix, enhance its advantages in the field of consumer electronics, further expand its applications in industrial and automotive electronics, and strive to become the world’s leading analog and embedded chip enterprise.

(II) Main business models

During the reporting period, there was no significant change in the company’s business model. The business model adopted by the company is the Fabess model of peers in the industry, mainly focusing on the design and sales of chips, and outsourcing wafer manufacturing, packaging and testing to third-party wafer manufacturing and packaging testing enterprises.

1. R&D mode

The company adopts the business model of Fabess, and product design and research and development are the core of the company’s business. The company attaches great importance to the construction and management of R&D innovation system, and has long been committed to establishing a standardized product R&D process and quality control system to ensure that all product series can achieve high-quality product design, effective quality assurance and reliable risk management at all stages of R&D. The company’s specific R&D process includes business processes such as project establishment stage, project design stage, product verification and mass production stage to ensure that the R&D and verification processes of products can be effectively controlled and managed.

2, procurement and production mode

The company focuses on the research, development and sales of chips. By entrusting the wafer factory and the packaging and testing factory external processing to complete the wafer manufacturing and packaging testing, the company itself is only engaged in the testing of some chips. This model is technology-driven, flexible and efficient.

In Fabess mode, the company mainly carries out research and development, sales and quality control of chip products, and the production of products is completed by outsourcing mode, that is, the company submits the integrated circuit data independently developed and designed to the wafer factory for wafer manufacturing, and then submits the manufactured wafers to the sealing and testing factory for packaging and testing. At present, the company mainly purchases wafers and their related packaging and testing services, and the company’s wafer foundry manufacturers and packaging and testing service providers are mainly well-known enterprises in the industry.

3. Sales model

At present, the company adopts the sales mode of "distribution is the main, supplemented by direct sales", that is, the company sells products through distributors and directly to terminal manufacturers. Direct selling mode means that the company sells its products directly to the end customers, and distribution mode means that the company sells its products to dealers outright.

(3) the industry situation

1. The development stage, basic characteristics and main technical threshold of the industry.

1. Industry

The company’s main business is the research and development, design and sales of analog and embedded chips, and its industry belongs to the integrated circuit design industry. According to the National Economic Industry Classification of People’s Republic of China (PRC) (GB/T4754-2017), the company belongs to "Computer, Communication and Other Electronic Equipment Manufacturing" in "Manufacturing", and the industry code is "C39". The integrated circuit design industry in which the company is located belongs to the encouraged industry stipulated in the Guidance Catalogue for Industrial Structure Adjustment (2019 edition) promulgated by the National Development and Reform Commission. The competent government department is the Ministry of Industry and Information Technology, and the industry self-regulatory organization is the China Semiconductor Industry Association.

2. Overview of industry development

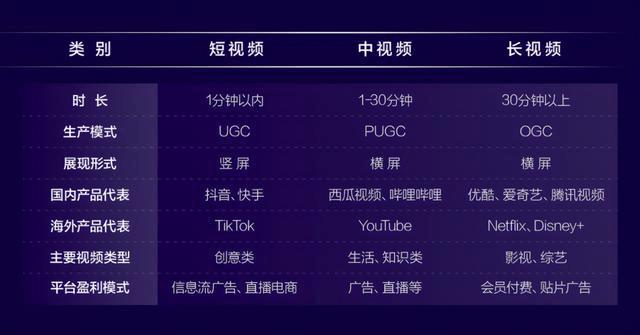

(1) integrated circuit industry

Integrated circuit industry is the core of information technology industry, and it is a strategic, basic and leading industry that supports economic and social development and guarantees national security. Integrated circuit products can be mainly divided into digital chips and analog chips according to their functions, in which digital chips refer to integrated circuit chips designed and operated based on digital logic and used to process digital signals, including micro-components, memory and logic chip adapter power management chips; Analog chip refers to an integrated circuit chip that processes continuous analog signals.

As the market performance in the second and third quarters of 2023 was slightly better than expected, at the end of November 2023, the World Semiconductor Trade Statistics Organization (WSTS) raised its forecast for the global semiconductor market in 2023, from the previous US$ 515 billion to US$ 520.1 billion, and the global semiconductor market in 2023 decreased by 9.4% compared with that in 2022.

According to WSTS forecast, the semiconductor market in all regions of the world will pick up in 2024, especially in America and Asia-Pacific region, which will achieve double-digit growth. It is predicted that the global semiconductor market will recover strongly in 2024, with a forecast growth of 13.1% to US$ 588.4 billion.

In the long run, the global and China IC industry will continue to grow. In recent years, emerging industries such as new energy vehicles, 5G, autonomous driving, data centers, industrial automation, artificial intelligence, Internet of Things, and wearable devices will form strong future demand. In the next few years, the growth rate of communication, consumer electronics, data center and other fields will slow down, while the fields of automobile and industrial use will grow rapidly.

China is the world’s largest demand market for integrated circuits, especially for high-end chips with high value. The import amount of chips far exceeds the export amount, which shows that there is a lot of import substitution space in the chip field in China. It has become an urgent problem for China’s high-end integrated circuit industry to realize self-control and import substitution. In order to promote the process of chip localization, in May 2015, the State Council released "Made in China 2025", which proposed that the chip self-sufficiency rate should reach 70% in 2025.

According to the statistical bulletin of national economic and social development in 2023 issued by the National Bureau of Statistics, China’s annual output of integrated circuits in 2023 was 351.44 billion, an increase of 6.9% over the previous year. In 2001, the number of integrated circuits exported was 267.8 billion, down by 1.8% over the previous year, amounting to 956.8 billion yuan, down by 5.0% over the previous year, ranking fourth among China’s major commodity exports. The number of integrated circuits imported was 479.6 billion, down by 10.8% over the previous year, and the amount was 2,459.1 billion yuan, down by 10.6% over the previous year, ranking first among China’s major commodity imports.

(2) analog chip industry

Analog integrated circuit products have a long life cycle, and their downstream applications are widespread and scattered, which is a barometer of the development of the whole market. Thanks to the technology accumulation of the industry itself and the development of downstream application fields such as consumer electronics, smart home, intelligent security, automotive electronics and industrial control, the analog integrated circuit industry has maintained steady development. According to WSTS forecast, the global analog chip market scale will reach 84.1 billion US dollars in 2024, an increase of 3.7% compared with 2023.

In 2023, the growth rate of China’s analog chip market will slow down, but it is expected to exceed 300 billion yuan, accounting for more than 50% of the global analog chip market. In the short to medium term, China will remain the largest analog chip consumer market in the world.

With the domestic demand for analog chips in automobile, industry, communication and other fields, and the domestic analog chips have great room for improvement in localization rate, the analog chip market in China will continue to grow in the future.

3, the technical level and characteristics of the industry

In terms of high-power charging, the charging power of consumer terminals represented by mobile phones has gradually increased. The conventional 18W charging power has been gradually replaced by 33W, and some high-end models and flagship models have introduced charging power of 200W and above, which has driven the penetration rate and charging power of high-power charging to continue to increase.

In terms of miniaturization charging, the third generation semiconductor technology and high integration scheme make the power density of adapters increase and the number of peripheral devices decrease, and miniaturization charging scheme becomes the market trend.

In the end-to-end complete solution, the complete solution can reduce the system cost of the terminal manufacturer and shorten the product development cycle of the terminal manufacturer. For chip manufacturers, providing an end-to-end complete solution requires chip manufacturers to fully understand the whole system, break through the limitations of single product research and development, and have higher requirements for chip manufacturers.

4, the main technical threshold

The downstream applications of the company’s products include high-end consumer fields such as mobile phones and notebook computers, and automotive and industrial fields. Among them, the internal power management chip of mobile phone requires high volume, stability and consistency, and the company’s products are mainly used for charging management and battery management, which requires high safety and performance; Automotive and industrial application scenarios require high chips. Therefore, there are high technical barriers in the industry where the company is located.

2. Analysis of the industry position of the company and its changes.

(1) The company is one of the few companies in China that can directly compete with international manufacturers in the same industry and realize domestic substitution of high-end products.

Analog and embedded chip companies with outstanding R&D strength and large-scale operation capability are mainly concentrated overseas. Nanxin Technology is one of the few companies in China that can directly compete with international manufacturers in the field of power supply and battery management and realize domestic substitution of high-end products. In the field of consumer electronics applications such as mobile phones, the company directly competes with international manufacturers in the same industry, and replaces the market share of some international manufacturers, helping domestic substitution of chips. Among the products represented by charging management chips, the key technical indicators of some models of the company have already possessed the performance of competing with international manufacturers or surpassing foreign competitors.

(2) The company is the backbone in the field of domestic analog chips.

After years of development, the company has been among the forefront of domestic analog chip design companies and has grown into the backbone of the domestic analog chip field. As a design company focusing on power management chips, the company’s products cover the whole charging link, and it is one of the few local enterprises with complete solutions from power supply end to equipment end. In the fields of smart phones, automotive electronics, industry and pan-consumption, the company has opened up the whole product application field, with rich product matrix, completed the end-to-end product layout of each application scenario, and strengthened the overall product innovation competitiveness of the company. With forward-looking product definition ability and strong research and development ability, the company has the advantages of leading performance and high reliability, and has been widely recognized by customers in the fields of smart phones, automotive electronics, industry and pan-consumption. In the field of smart phones, the company’s products have entered well-known mobile phone brands such as Glory, OPPO, Xiaomi, vivo and Voice. In the automotive field, the company’s products have entered Volvo, Hyundai and other brands; In the industrial field, the company’s products have entered brands such as TTI; In the field of pan-consumption, the company’s products have entered Anker, Zimi, Belgin, Harman and other brands.

3. The development of new technologies, (), new formats and new models during the reporting period and the future development trend.

1. New technology

(1) high efficiency and low consumption

In the field of power supply, power conversion efficiency and standby power consumption are always one of the core indicators. All countries in the world have introduced various energy efficiency standards, such as American Energy Star, German "Der Blaue Engel Standard" and China Certification Center. The industry realizes the high efficiency and low power consumption requirements of power management chip and its power supply system by developing more advanced circuit topology and switch control technology, lower conductance power device technology and more sophisticated high voltage start technology.

(2) integration

The thinness and thinness of portable devices has always been the key demand to improve the user experience, and the technology of power supply and battery management chip has also shown an increasingly significant integration trend. On the one hand, in order to achieve the goal of thinness and thinness, the terminal product requires higher integration and fewer peripheral devices, so as to reduce the number of components in the whole scheme, save circuit board space and reduce the size of the whole scheme; On the other hand, the terminal equipment is becoming more and more complex, and its more functional features and more complex processors require more advanced power management solutions, and it is required to integrate more functions on a smaller silicon chip to achieve stronger system power performance. At the same time, the integrated power supply and battery management chip can effectively reduce the system cost and design complexity, shorten the research and development cycle of terminal manufacturers, and improve the long-term reliability of the system.

(3) Simulation technology and embedded processing technology cooperate with each other.

With the system functions becoming more and more complex, the requirements for energy consumption are getting higher and higher, and the requirements for monitoring and controlling the running state of power supply and battery are also getting higher and higher. The design of power supply and battery management chip is no longer satisfied with real-time monitoring of current, voltage and temperature, but also needs to realize the requirements of diagnosing power supply, battery working state and flexibly setting output voltage and current parameters. In addition, the power management chip needs real-time communication with the main system to meet the power supply requirements of each functional module of the system, so as to meet the requirements of intelligent power management and regulation. Simulation technology and embedded technology cooperate with each other, which promotes the development of power supply and battery management chip in the intelligent direction. Through the seamless combination of hardware and embedded software, the functions of monitoring, controlling and communicating the state of power supply and battery can be flexibly realized. In recent years, with the advantages of flexible debugging, fast response, high integration and high controllability, a new generation of power supply and battery management chips combining analog technology and embedded processing technology are gradually expanding to many application fields.

2. New industries

(1) The third generation compound semiconductor gallium nitride (GaN) has become a market trend.

Transformer is the largest component in the charger, and the key to miniaturization of charger lies in the miniaturization of transformer. Generally, the higher the switching frequency, the smaller the required transformer volume. The switching frequency of traditional Si materials has reached the upper limit, and the third generation semiconductor materials can achieve faster switching speed, thus allowing higher switching frequency and further reducing the size of the charger. With the characteristics of fast switching speed, high power density, high voltage resistance and high frequency, the third-generation compound semiconductor small-volume charging adapter based on GaN is increasingly widely used in high-end models. According to Yoe data, the application scale of power GaN in the consumer market is expected to increase from 79.6 million US dollars in 2021 to 964.7 million US dollars in 2027, with a compound annual growth rate of 52%.

In the process of expanding the market of GaN power supply, the requirements for the integration of chips are getting higher and higher. The original GaN power supply is generally designed by controller+driver+gallium nitride power device, which is not only complicated in circuit layout, relatively difficult in product development, but also expensive. In recent years, based on the technical advantages of power chips, outstanding chip manufacturers in the industry have introduced highly integrated power chips with built-in GaN power devices, that is, sealed GaN chips. By improving the chip integration, the peripheral components are further reduced, the size of the charger is reduced, the difficulty of system development and debugging is also reduced, and the product reliability is improved.

(2) Intelligentization and electrification drive the rapid development of automotive electronics.

The intelligent electrification reform is reshaping the traditional automobile industrial chain, and automobile electronics has become the core factor to promote the reform. Various analog and embedded chips, sensors and computing chips are widely used in various functional modules of electric smart cars, which drives the rapid development of automobile electronics and the rapid improvement of the value of automobile electronics supply chain. According to Roland Berger’s prediction, the value of BOM (bill of materials) related to automotive electronics will increase from $3,130/car to $7,030/car from 2019 to 2025, in which the value of intelligent BOM will increase by $1,665/car and the value of electric BOM will increase by $2,235/car.

In the field of power supply and battery management chips, thanks to the wide application of intelligent functions such as automatic driving and intelligent cockpit in automobiles, the demand for chips related to digital display, human-vehicle interaction and ADAS, such as display screen power supply, backlight drive, USB car charging, system and camera power supply, has greatly increased. Under the electrification reform, the traditional fuel powertrain system has been eliminated, and the electric powertrain system has adopted new components such as BMS and DC-DC converter, and the demand for power supply and battery management chips has greatly increased. Automotive electronics has become another field that promotes the rapid growth of the power supply and battery management chip market after the consumer field.

3. New format

(1) governments of various countries or regions increase their support for industries.

In recent years, due to the shortage of chips in many countries, integrated circuit manufacturing powers and regions, including the United States, Japan and Europe, have re-recognized the importance of advanced integrated circuit technology and supply security, and have introduced supportive policies to accelerate the layout of semiconductor industries including integrated circuits, and strengthen government support for industries to consolidate the competitiveness of enterprises. Take Europe as an example. On September 21, 2023, the European Chip Act came into effect. The EU will invest more than 43 billion euros to boost the European chip industry. The Act requires that the global share of EU chip production should be increased from 10% in 2023 to 20% in 2030 to meet its own and world market demand.

(2) The demand for domestic substitution of integrated circuits in the whole industry is significant.

Integrated circuits are very important to the development of China’s information industry. Although China is the largest chip market in the world, it has long been dependent on imports, and it is also in a weak position in the global chip industry. Especially since foreign countries cut off supply in recent years, the China market has been greatly affected. It is urgent to speed up the development of its own core technology and improve the self-sufficiency rate of chips. The State Council released "Made in China 2025", which proposed that the chip self-sufficiency rate in China should reach 70% in 2025. According to TechInsights, the chip self-sufficiency rate in China will be less than 30% in 2023. In order to realize the independent control of the industry, integrated circuits, as a national strategic industry, are expected to receive strong policy support, and the industry and capital environment will continue to improve.

At the same time, as the focus of global terminal manufacturing and semiconductor manufacturing shifts to the Asia-Pacific region, the field of power management chip design also shows a trend of shifting from Europe, America and other regions to China. Under the interaction of multiple factors, more and more OEM/ODM manufacturers in China began to choose local suppliers as secondary suppliers when they were out of stock, and the demand for integrated circuit localization increased significantly.

Specifically, in the field of power management chips, local power management chip design companies have accelerated their technological catch-up under the background of escalating trade friction between China and the United States, and the gap between the overall technical level and foreign design companies has been narrowing. The power management chips designed and developed by domestic enterprises have gradually replaced the share of foreign competitors in many application fields, especially in the consumer electronics market with medium and small power segments. The shipments have increased year by year, and the market share has also gradually increased.

4. New mode

(1) The industrial chain is more closely coordinated.

Influenced by the uncertainty of macro-political and economic situation and the trade friction between China and the United States, the competition of global integrated circuit industry has intensified, and industrial synergy has become a trend. With the increasingly fierce "arms race" of international chip giants, the core competitiveness of integrated circuit industry enterprises is no longer just a single dominant technology or product, but also comes from the control and operation of highly concentrated and efficient resources in the industrial chain, and the industrial competition mode has officially changed to "whole industry chain competition".

The coordinated development of industrial chain is conducive to the faster progress of the industry. Chip designers are more closely coordinated with upstream wafer manufacturers, packaging and testing manufacturers and downstream terminal manufacturers, and it is more important to build an all-round semiconductor ecosystem in the upstream and downstream of the industrial chain. Through cooperation with downstream terminal manufacturers, we can better understand the terminal requirements and guide the research and development direction; By cooperating with upstream wafer manufacturers and packaging and testing manufacturers, we can strengthen the supply chain capability and jointly promote the technological progress in wafer manufacturing and packaging and testing.

In the process of coordinated development of industrial chain, industry competition will pay more attention to the competition of comprehensive strength of products, customers and talents, and the industrial competition mode will develop towards systematization and ecology.

(IV) Core technologies and R&D progress

1. Core technologies and their advanced features and changes during the reporting period.

During the reporting period, the company added seven core technologies, namely, lithium battery monitoring technology, zero-voltage switching charge pump control technology, low-voltage self-starting technology, secondary control fully integrated soft-switching Fyback technology, SmartHighSideDriver technology, automotive smart fuse technology and automotive antenna LDO technology.

2. R&D achievements obtained during the reporting period

During the reporting period, the company applied for 62 new intellectual property projects, including 62 invention patents; By December 31st, 2023, the company had obtained 89 invention patents and 61 layout designs of integrated circuits.

3. R&D investment table

Reasons for significant changes in total R&D investment compared with the previous year

Mainly due to the company’s increased investment in R&D, the investment in R&D personnel salary and R&D materials increased significantly during the reporting period compared with the same period of last year.

4. Research projects

25/223

28/223

5. R&D personnel

6. Other explanations

Iii. Analysis of core competitiveness during the reporting period

(A) analysis of core competitiveness

1. The leading domestic chip manufacturer with end-to-end complete solution capability.

The company has a number of product lines, covering the entire charging link management link, and is a leading chip manufacturer with end-to-end complete solution capability in China. The company is deeply deployed in the fields of smart phones, automotive electronics, industry and pan-consumption. The company will continue to develop new products around customer applications, complete the product layout of the overall charging link of the scene, and continuously enhance the competitiveness of products.

At the R&D level, providing a complete solution needs to form a set of proprietary technology system based on a full understanding of the whole system, which is not limited to single-point or local cognition, so it can strengthen cooperation with customers in a wider range and at a higher level. By providing customers with complete solutions, we can deeply understand the pain points of customers and solve practical problems for customers, thus promoting the company’s multi-dimensional and all-round innovation.

On the quality control level, the compatibility, adaptability and reliability of products are the keys to the performance and quality of terminal equipment. A complete solution can reduce the compatibility and adaptability of products between different manufacturers, effectively improve the quality control and accountability efficiency of the whole procurement link, and thus ensure the stable operation of terminal equipment to the greatest extent.

At the sales level, customers can effectively reduce their operating and purchasing costs and shorten their product development cycle by purchasing complete solutions. The company can also promote the sales of other related products through the early introduction of a single product, thus improving the sales efficiency of the company’s products. Through the sales and support of the whole package, we can further enhance customer stickiness and build a higher competitive threshold.

2. Adhere to technological innovation, precipitate excellent product definition ability, and continuously create value for customers.

The company has long adhered to technological independence and innovation. Through years of insight into the market and continuous definition of new products, the company has accumulated excellent product definition ability, which can actively and quickly match the development trend of the industry and the demands of customers. The planned product R&D roadmap has a high degree of fit with the future product needs of downstream customers, creating more valuable and competitive products for customers.

Defining and launching products in time according to market demand is based on the company’s management’s rich industry experience and keen market insight, which requires the R&D team to have rich technical accumulation and the ability to solve new demands and problems in the R&D process, and the production, operation, marketing and other departments to respond quickly and implement them. All the above factors reflect the company’s comprehensive competitiveness such as R&D ability, customer accumulation and supply chain coordination.

3. High-quality brand customer barriers+self-controllable supply chain

With excellent technical innovation and product research and development capabilities, the company continues to provide customers with more valuable and competitive products, which has been widely recognized by the market. Brand customers are strict and cautious when choosing chip suppliers, and the entry threshold is high. They need to go through long-term product review and verification before they can enter their supply system. The company’s products have been widely recognized by end customers in performance, delivery, quality and other aspects. During the reporting period, they won several awards from customers such as OPPO, vivo, Glory and Lenovo, which were deeply affirmed and recognized by customers.

The long-term cooperation between the company and the end customers of major brands has formed a strong stickiness, which is helpful for the company to achieve stable operation. At the same time, brand end customers have strong comprehensive strength and unremitting pursuit of technological innovation, which represents the development direction of the industry. With the development of brand end customers, the company can timely understand and meet the latest needs of customers in the process of serving customers, can continuously maintain the forward-looking research and development and the leading position of products, and promote the virtuous circle of company products from research and development to landing and continuous iteration.

The company attaches great importance to the construction of independent and controllable supply chain system, and actively seeks in-depth cooperation with leading suppliers in the industry. At present, it has established long-term cooperative relations of mutual trust with many leading suppliers in the industry.

The company’s main suppliers are local partners, ensuring the company’s supply chain to be autonomous and controllable. In addition, the company has established strategic cooperative relations with major suppliers, gained the advantage of purchasing cost by gathering order demand, and at the same time cooperated with suppliers in depth to build its own technology, so as to maintain the leading position of the company’s products in technology and packaging and enhance the competitiveness of products.

4. Improve the product layout with multiple application scenarios, and the platform-based development has achieved initial results.

During the reporting period, the company achieved rapid growth in the fields of smart phones, automotive electronics, adapters, industry and pan-consumption. In the future, the company will continue to improve the product layout of various application scenarios and enhance product competitiveness and profitability in various application fields.

Through continuous optimization and improvement of product layout, the company will gradually develop into a more competitive platform company, with a more stable business structure and further increased risk resistance, laying a solid foundation for the company’s further development.

(II) Events that have seriously affected the core competitiveness of the company during the reporting period, impact analysis and countermeasures.

Fourth, risk factors

(A) Not yet profitable risk

(2) Risk of sharp decline in performance or loss

(C) core competitiveness risks

(1) Risk of product development and technological innovation

The company’s products are mainly used in consumer electronics. The consumer electronics industry is changing rapidly and the market window is short, which requires the company to launch new products quickly and update and iterate continuously with the market changes. Therefore, the company needs to maintain a high sensitivity to market changes and the iterative trend of mainstream technologies, and formulate a dynamic technology development strategy. In the future, if the company’s technology R&D level lags behind the upgrading level of the industry, it will lead to the waste of the company’s R&D resources and miss the market development opportunities, which will have an adverse impact on the company.

(2) Risk of R&D personnel loss or shortage

Integrated circuit design enterprises usually need to train R&D designers for a long time, build experienced design teams, and constantly introduce excellent design talents. With the increasingly fierce market competition, the competition for R&D talents among companies in the industry is increasing. In the future, if the salary level of the company is not competitive, the human resource management and internal promotion system are not effectively implemented, and there is no effective equity incentive measures, it will be difficult to introduce more outstanding technical personnel, and even lead to the loss of existing backbone technical personnel, which will have an adverse impact on the company’s technology research and development.

(3) Risk of core technology leakage

The company’s core technology runs through the process of product development, design and production, which is very important for the company to control production costs and improve product performance and quality, and is the company’s core competitiveness. If the protection of core technologies is unfavorable or the outflow of core technicians leads to the leakage, theft or imitation of key technologies by competitors, it may have an adverse impact on the company’s technological innovation, business development and even operating performance.

(4) Operational risks

(1) The risk of high customer concentration under the distribution mode.

During the reporting period, the total sales revenue of the company to the top five customers accounted for 74.35% of the current operating income, accounting for a relatively high proportion. The company’s customers are mainly well-known electronic component dealers in the industry.

In the future, if the operation and credit status of the company’s major customers or terminal brand manufacturers are adversely changed, or the current operation and procurement strategies of major customers are greatly changed, the company will have certain uncertainty about the sales revenue of major customers, thus affecting the company’s stable profitability. In addition, if the demand of some major customers decreases, the company’s revenue growth rate may slow down or even decline.

(2) The risk of high concentration of suppliers

The company’s main wafer suppliers and sealing and testing suppliers belong to domestic industry leading enterprises, and the concentration of suppliers is relatively high.

Wafer manufacturing and packaging testing are both capital and technology-intensive industries, and the number of suppliers who meet the company’s technical and production requirements is relatively small. In the future, if the company’s main suppliers have adverse changes in their operations, limited production capacity or tense cooperation relations, or because of adverse changes in the overall prosperity of the industrial chain, suppliers may not be able to deliver goods in full and on time, and may put forward more unfavorable commercial cooperation conditions such as supply price, payment requirements and delivery period, which will adversely affect the company’s production and operation.

(3) Management risks caused by the expansion of the company’s scale

During the reporting period, the company’s business continued to develop, and the company’s corresponding asset scale and personnel were also expanding. With the public offering of the company’s shares and the implementation of investment projects with raised funds, the company’s business scale and personnel team are expected to further expand, which will put forward higher requirements for the company’s management, resource integration, technology development, market development, quality control and other aspects. If the company’s internal management level can’t meet the requirements of the company’s rapid development, it will make the company likely to have management risks caused by scale expansion, which will adversely affect the company’s further development.

(4) The risk that the company’s revenue will maintain steady growth.

During the reporting period, the scale of the global semiconductor market declined due to local geopolitical wars, declining demand for terminal applications and other factors. In the short term, the global economic growth is expected to slow down, the demand in the terminal consumer market will be difficult to boost, the competition among companies in the same industry in the world will continue to intensify, or it will have an adverse impact on the company’s products, resulting in the company’s operating income can not continue to grow.

(V) Financial risks

1. Risk of fluctuation of gross profit margin of the company’s products

In 2023, the gross profit margin of the company’s main business was 42.30%, a decrease of 0.74 percentage points compared with the same period of last year, and there were fluctuations in gross profit. The gross profit margin of the company’s main products is mainly affected by downstream demand, product price, product structure, materials and processing costs and the company’s technical level. If the recovery of the industry is less than expected, or geopolitical instability is unfavorable to the downstream consumer electronics market, the risk of further weakening of consumer market demand and further decline of the company’s gross profit margin will not be ruled out, which will adversely affect the company’s profitability. Therefore, if the company can’t optimize the gross profit margin level through continuous technical iteration, optimizing product structure and reducing product unit cost, it may lead to a decline in the company’s gross profit margin, thus affecting the company’s profitability and performance.

2. Inventory depreciation risk

At the end of 2023 and 2022, the book value of the company’s inventory was 525,382,600 yuan and 335,584,000 yuan respectively, and the inventory scale increased with the expansion of business scale. If the market demand environment changes, the market competition intensifies, or the company cannot effectively expand sales channels, optimize inventory management, and reasonably control inventory scale, it may lead to unsalable products and inventory backlog, thus increasing the risk of inventory depreciation and adversely affecting the company’s operating performance.

3. Risk of exchange rate fluctuation

In 2023 and 2022, the company sold and purchased overseas, quoted and settled in US dollars. With the expansion of the company’s business scale, the amount of overseas sales and purchases is expected to increase further. Although the company has considered the possible fluctuation of exchange rate between the conclusion of contracts or orders and the receipt and payment of funds, there is still great uncertainty about the exchange rate change with the changes of domestic and international political and economic environment. If the exchange rate between RMB and USD fluctuates greatly in the future, it will have a certain impact on the company’s performance.

(VI) Industry risks

China is the world’s largest consumer market for analog chips. With the two-wheel drive of new technologies and industrial policies, the demand for analog chips in China will become stronger in the future. At present, the global analog chip market is dominated by European and American manufacturers such as TI, which occupy the high-end product market of China analog chip industry, and by virtue of their advantages in capital, platform, research and development, they create greater competitive pressure on domestic enterprises trying to enter the middle and high-end product market. Faced with the competitive pressure of these head manufacturers, the company may adopt the strategy of providing customers with better cost performance to obtain orders for products with similar performance, which may lead to the risk of pressure on product profit level and cash flow. In addition, in recent years, the number of domestic analog chip manufacturers has increased, and the industry competition has intensified, and the company may face the risk of declining profitability.

(VII) Macro-environmental risks

In recent years, international trade frictions have been constant, and some countries have tried to restrict the development of related industries in China by means of trade protection. The company has always strictly abided by the laws of China and other countries, but the international situation is changing rapidly. Once the company’s business is limited, suppliers are unable to supply or customers’ purchases are constrained due to international trade frictions, the normal production and operation of the company will be greatly adversely affected.

In recent years, the United States has successively listed some enterprises in the upstream and downstream of the industrial chain in the "entity list", or restricted the access of some China companies to semiconductor technology and services by other means. Some suppliers of the company inevitably use American equipment or technology, and if the trade friction continues to intensify, it may lead to restrictions on their supply or service to the company, thus adversely affecting their operations.

(8) Risks related to depositary receipts

(9) Other major risks.

V. Main operations during the reporting period

In 2023, the company realized an operating income of 1,780,402,300 yuan, an increase of 36.87% year-on-year; Operating profit was 262,693,700 yuan, up 10.21% year-on-year; The total profit was 266,277,800 yuan, up 10.34% year-on-year; The net profit attributable to owners of the parent company was 261,357,500 yuan, up 6.15% year-on-year.

During the reporting period, the company’s total operating income increased by 479,621,500 yuan year-on-year, with an increase of 36.87%, mainly due to the expansion of business scale and sales growth.

VI. The Company’s Discussion and Analysis on the Company’s Future Development

(A) the industry pattern and trends

(II) Company development strategy

With the business vision of "becoming the world’s leading analog and embedded chip enterprise", the company has launched high-performance power supply and battery management chips in the fields of consumer electronics, industry and automotive electronics with efficient research and development capabilities, excellent technological innovation capabilities and strict quality control capabilities, helping domestic chips to be self-controllable. The company has established an efficient linkage mechanism and long-term and stable cooperative relationship with suppliers such as wafer manufacturers and packaging and testing manufacturers, which has improved the company’s supply chain capability; The company has established an increasingly close partnership with terminal brand customers, kept abreast of the new direction and trends of demand-side technology in good cooperation, and conducted targeted R&D iterations on products, thus improving R&D efficiency. In the future, the company will continue to strengthen technology accumulation, continuously upgrade existing products, continuously enrich the product matrix, enhance its advantages in the field of consumer electronics, expand its applications in the field of industry and automotive electronics, and strive to become the world’s leading analog and embedded chip enterprise.

(3) Business plan

1. Strengthen R&D investment, continue product innovation, and promote the steady growth of the company’s main business.

In 2024, the company expects to maintain the R&D expense rate of the previous year and continuously strengthen R&D investment to meet the company’s growing product demand. The company will adhere to technological innovation, take the application scenario as the traction, continuously lay out new products and new application fields, further consolidate and expand the competitive advantage of the company’s main business, and realize the steady growth of the company’s performance.

2. Formulate the company’s long-term development strategy and promote the steady and rapid growth of the company.

The company has set a long-term development strategic goal and determined a short-term business plan for the next three years. The company will make joint efforts in smart phones, automotive electronics, industry and other consumer markets, continuously enrich product categories, realize end-to-end product layout of various application scenarios, and further expand its competitive advantage. Through root technology development and product technology innovation, the company will deposit excellent product definition ability, continue to create value for customers, build a deeper business moat, and promote the company’s steady, high-speed and sustained growth.

3. Consolidate and enhance the market share of the domestic market and actively explore overseas markets.

Guided by market demand, the company will continue to pay close attention to the changes in the habits of end users, deeply understand the actual needs of end users for charging products, enhance customer stickiness, explore more efficient and stable customer cooperation modes, and develop new domestic customers to enhance the market share of the domestic market. By establishing overseas sales channels, actively expand overseas customers and enhance business development space.

4. Continue to promote the company’s cost reduction and efficiency improvement, and increase the profit margin.

Although the global semiconductor market is expected to recover in 2024, the fierce competition in the domestic chip market is expected to continue. Carrying out cost reduction is conducive to reducing the company’s expenses, improving the company’s profit level, improving efficiency, strengthening the input-output ratio and improving the conversion efficiency of input. In 2024, the company plans to reduce costs and increase efficiency as a key task of its annual operation, which will be implemented in relevant departments and jobs to cope with the weak national economy and intensified competition, and to keep the company’s revenue growing steadily and continuously.

5. Strengthen organizational construction and improve management efficiency.

In 2024, the company will continue to strengthen organizational capacity building, carry out the capacity improvement of middle and back-office business departments, improve the overall business process efficiency, and build an efficient business process system with feedback mechanism. The management of the company will further improve the efficiency of operation and management, continuously strengthen the company’s core competitiveness, profitability and comprehensive risk management capabilities, and help the company’s business scale development, with a view to achieving rapid development and giving back to investors.

6. Promote the standardized operation of listed companies and improve their management ability and governance level.

In 2024, The Company will strictly abide by the Company Law of People’s Republic of China (PRC) (hereinafter referred to as the Company Law), the Securities Law of People’s Republic of China (PRC) (hereinafter referred to as the Securities Law), the Listing Rules of science and technology innovation board Stock Exchange of Shanghai Stock Exchange, the Self-regulatory Guidance of science and technology innovation board Listed Companies of Shanghai Stock Exchange No.1-Standardized Operation and the Articles of Association of Shanghai Nanxin Semiconductor Technology Co., Ltd. (hereinafter referred to as the Articles of Association). Continue to promote the standardized operation of public companies, fully fulfill the obligation of information disclosure in accordance with the law, actively undertake corporate social responsibilities, improve the governance level of listed companies, continue to strengthen communication with investors, and protect the legitimate rights and interests of investors. At the same time, strengthen the training of the company’s business and system at all levels, improve management ability and level, formulate implementation plans, consolidate management responsibilities, promote the improvement of corporate governance and management level from top to bottom, and ensure the full completion of the annual business objectives.