The International Federation of Robotics (IFR) released its latest report "Global Robots 2019" in Shanghai on September 18th. This comprehensive report on the performance of the global robot market in 2018 shows that despite the two main application areas of the robot industry last year — — The automobile and electronics industries are facing headwinds, but the annual global sales of robots have reached a new high of $16.5 billion, and the global installed capacity has increased by 6% from the previous year to 422,000 units. IFR predicts that the installed capacity in 2019 will be lower than that in 2018, but the average annual growth rate from 2020 to 2022 can be maintained at 12%.

"In 2018, we saw the ups and downs of the market performance of the robot industry, but we still created a new sales record, even though this year was the main customer of robots — — A difficult year for the automotive and electronics industries. " The International Federation of Robotics President Junji Tsuda said, "Sino-US trade friction brings uncertainty to the global economy — — Customers tend to delay investment. But what is exciting is that the annual installed capacity still exceeds 400,000 for the first time. The long-term outlook of IFR shows that the continuous automation trend and continuous technological improvement will bring double-digit growth, and it is estimated that the installed capacity will reach about 584,000 units in 2022. "

According to the report, the top five industrial robot markets in 2018 are China, Japan, South Korea, the United States and Germany, accounting for 74% of the global installed capacity.

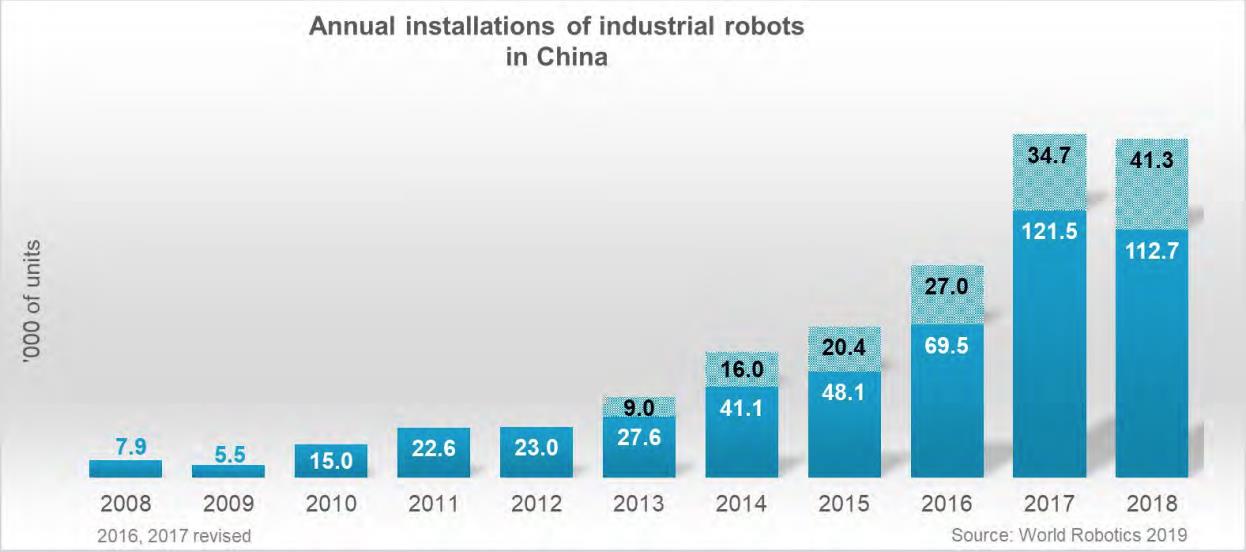

After eight years of rapid growth, the installed capacity of industrial robots in China showed an inflection point last year, with a slight decline. However, China is still the largest industrial robot market in the world, accounting for 36% of the installed capacity in the global market.

In 2018, the installed capacity of industrial robots in China was about 154,000 units, which was 1% lower than that in 2017, but still more than that in Europe and America combined. Last year, the total installed capacity of robots in China market reached 5.4 billion US dollars, an increase of 21% compared with 2017.

The annual installed capacity of industrial robots in China market from 2008 to 2018. The pictures in this article are all from the report of Global Robots 2019.

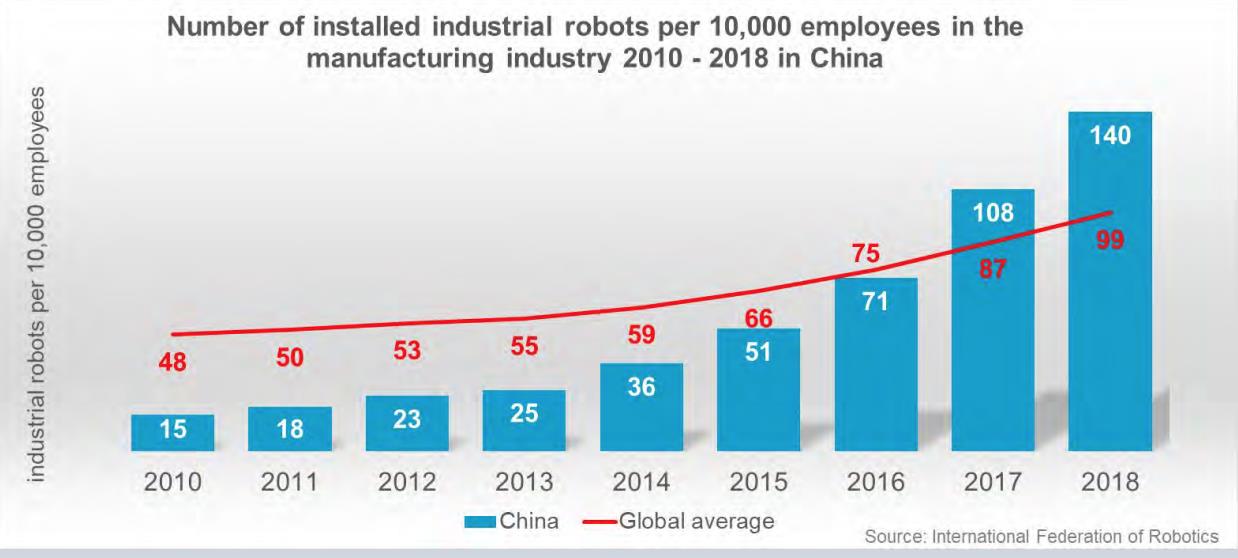

In 2018, the density of robots in manufacturing factories in China (the number of robots per 10,000 workers) was 9.3 times that of 2010, reaching 140. In the picture, the blue column shows the density of robots in China, and the red curve shows the global average level.

Nevertheless, there is still much room for improvement in the scale application of robots in China’s manufacturing industry. Globally, the density of robots in Singapore, South Korea and Germany ranks the top three, reaching 831, 774 and 338 respectively.

In 2018, the differentiation between independent and foreign brand robots was obvious. The total installed capacity of China local robots in the domestic market has increased by 5% (27% in 2018 and 22% in 2017), which shows that China’s policy orientation of encouraging its own brand robots has brought results. On the other hand, the installed capacity of foreign brands (including products produced by non-China suppliers in China) decreased by 7% to about 113,000 units (2017: about 122,000 units).

From 2016 to 2018, the annual installed capacity of industrial robots in various industries in China market. Electrical/electrical industry, automobile industry, metal and machinery industry have always been the top three application industries, but in 2018, the installed capacity of industrial robots in these three industries all declined. On the contrary, other industries have increased.

Annual supply of foreign robot brand suppliers and China local suppliers in various industries in 2017 and 2018. Under the background of declining automobile sales, the demand for industrial robots in automobile manufacturing industry is also decreasing. In the automobile industry, the market share of foreign brands is over 80%, which also explains why the sales of foreign brands of robots suffered a greater market impact last year.

As for the industrial robot market, which tends to be weak since last year, the robot companies interviewed by The Paper (www.thepaper.cn) during the 21st China Industry Expo recently said that the so-called "cold winter" in the industry is only a temporary phenomenon.

Li Gang, head of ABB’s robotics and discrete automation division in China and ABB’s robotics business in China, said that from the second half of last year to the first half of this year, sales and output in the China market, especially in the automobile market, did decline. But these declines are short-lived. In the long run, ABB is still optimistic about the development of China market. The reason is that China is changing from "manufacturing" to "intelligent manufacturing" and from a manufacturing power to a manufacturing power, and the basic elements of the market have not changed.

The epitome of the company’s optimism about the China market is that its new robot factory and R&D base in Shanghai have recently officially broken ground. The new factory is expected to be put into operation in 2021, with a total investment of 150 million US dollars (about 1 billion yuan). After completion, it will become ABB’s largest robot production base, and together with Swedish factories and American factories, it will form ABB’s global robot supply system.

Wang Hui, CEO of KUKA China, another "four families of global industrial robots", told The Paper that from the general trend, industrial robots still have a good development prospect in the next 10 to 20 years, although difficulties and constraints may be interspersed in the process. How does the hot artificial intelligence combine with industrial robots? How to move from concept to application? It is a trend worthy of attention in the future development of industrial robots.

Cao Yunan, general manager of Suzhou Ailite Robot Co., Ltd., a domestic industrial robot enterprise, also believes that the decline in sales of industrial robots in China is a temporary phenomenon. "Due to industrial upgrading, it is true that the 3C industry and the automobile industry are going downhill. But apart from these two traditional tracks, there are still many growing tracks for robot companies, such as logistics and consumer-oriented applications. "

At the press conference of Global Robotics 2019, Qu Daokui, chairman of China Robotics Industry Alliance and president of Xinsong Group, pointed out that in 2018, the sales volume of industrial robots in China declined for the first time, but the annual sales volume ranked first in the world for the sixth consecutive year, and the sales of self-owned brand robots maintained steady growth. Based on the current market situation and industry operation situation, China Robot Industry Alliance preliminarily predicts that the sales volume of industrial robots in China will increase by about 5% in 2019, among which the sales volume of self-owned brand industrial robots will increase by about 15%.

关于作者