As we all know, the financial industry is a famous "volume", which requires both academic qualifications and certificates. If you want to make progress in the financial industry, textual research is an inescapable fate for financial people.

Under the current "cold wave" of employment, which certificates are more valuable, which can help you get a better promotion and salary increase and achieve a further upgrade of your career?

With the increase of market uncertainty, the global job market is facing a new round of "cold wave".

It is reported that the number of layoffs of major investment banks in Europe and America will exceed 100,000 in 2022, and a large financial institution in Shenzhen has recently been exposed that it will lay off about 40% in the future. Many banks and securities companies have also begun to plan to implement layoffs at the end of the year.

In terms of salary, according to market statistics, the per capita salary of major securities companies "plummeted" in 2022. For example, the per capita salary of a large securities company in 2022 was only 786,300 yuan, down about 20% from 2021. Life at the bank is not easy either. For example, the per capita monthly salary of a large bank in the first half of 2023 decreased by 13.62% year-on-year.

Alas, a good job is hard to find, but there seems to be a ray of "warm wind" in this cold wave.

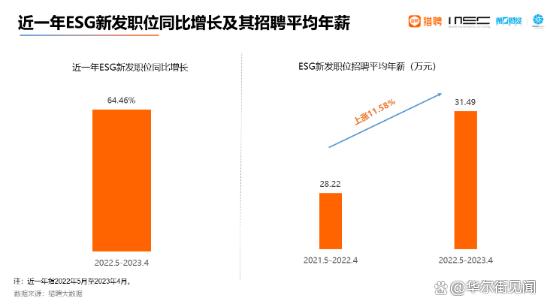

According to the data of "ESG Talent Attraction Insight Report 2023", as of April, 2023, the number of new positions in ESG increased by 64.46% year-on-year, and the average annual salary of ESG recruitment was 314,900, up by 11.58% year-on-year.

When you open the recruitment software, the salary of ESG post is indeed "a ride." Investment institutions, enterprises, rating agencies, brokers, consulting companies and other third-party organizations are all recruiting ESG-related talents.

According to a headhunter in ESG industry, "The starting salary of ESG freshmen is now 20,000-40,000, and the monthly salary is even 150,000-200,000".

So, why are ESG jobs so popular?

The concept of ESG can be traced back to the UN Global Compact initiated by UN Secretary-General kofi atta annan in 2000, which emphasized the importance of human rights, labor security, environment and corruption prevention. In 2005, Annan invited the heads of the 50 largest financial institutions in the world to hold the "Who Cares Wins". During the meeting, it was highly agreed that the three elements of ESG are the cornerstones for the long-term stable development of the financial industry in a rapidly changing world.

In order to ensure that the concept of ESG theory is not reduced to theoretical empty talk, the market has explored a road to the development of ESG ecosystem in the past decade or so.

Its implementation path is mainly as follows:

1)ESG guides international organizations, regulatory authorities and exchanges to formulate a set of ecological rules;

2) based on the above rules, enterprises can disclose according to the corresponding industry conditions;

3) Rating and investment consulting agencies publish enterprise ratings in combination with enterprise data;

4) Finally, investors will incorporate ESG factors according to the above information and evaluate the enterprise.

In this context, ESG can form a closed-loop process in the capital market, which permeates all aspects of the ecosystem; In recent years, the increasing investor demand has also pushed financial institutions and other stakeholders to provide higher quality ESG-related products and services.

At present, ESG investment is attracting more and more attention and recognition from the global market.By Q2 of 2023, 5,372 financial institutions around the world have signed PRI, and it is estimated that the compound annual growth rate from 2006 to 2023 will be 28.6%. According to PricewaterhouseCoopers, the global ESG asset management scale will reach 33.9 trillion US dollars in 2026, accounting for 22% of the global asset management scale.

From the structural point of view, the future development potential of China’s ESG market is still huge.Due to the relatively late start of ESG investment in China, as of Q2 of 23 years, the total proportion of PRI signatories in China is only 2.6% in the world, far lower than that in Europe and America.

The "Fourteenth Five-Year Plan" clearly stated that China should implement the new development concept and continue to promote high-quality development in the future.In theory, ESG can provide guiding principles for the development of enterprises in three aspects: environment, society and governance, and point out the way for the high-quality development of enterprises; In practice, ESG can provide methods and indicators to evaluate the performance of enterprises in environmental, social and governance aspects, and provide necessary tools for enterprises to practice high-quality development.

It can be said that the concept of ESG coincides with the concept of high-quality development put forward by China, and with the steady progress of the "Tenth Five-Year Plan", ESG investment will also become popular in China, which is not only an important reason for the continued popularity of ESG in China in the past two years, but also the fundamental basis for enterprises to be willing to train ESG talents with high salaries.

Of course, the ESG industry is so hot now, and its requirements for recruiters are relatively high.

According to the recruitment data, among ESG talents, the total proportion of master’s degree is 81.21%, of which the proportion of master’s degree is 78.2%.

In addition, ESG talents not only know a single financial knowledge, but also need to learn more subjects, such as social science and environmental science. In addition, we will also use big data and artificial intelligence technologies and use data analysis to build ESG rating indicators.

This also puts higher demands on ESG practitioners. It may be that "it is not enough to learn only one subject, but also to have multiple interdisciplinary backgrounds. Therefore, the threshold of ESG is not low, and it needs talents with complex backgrounds", a senior ESG headhunting consultant told Wall Street.

So, how to gain market recognition and enter ESG industry? -It may be a good choice to improve your professional ability by studying CFA exam.

As mentioned above, what ESG industry lacks most at present is the compound talents with outstanding ability. However, due to the late start of domestic ESG market, many practitioners have become monks halfway-self-taught ESG through some short-term training and public information.

This leads to the fact that although it can be explained in theory, it can not be well implemented in daily practical work, which is also one of the main pain points facing the market at present.

However, CFA exam has been verified and assessed by the financial market for many years, and its knowledge system is complete and comprehensive, including economics, financial analysis, corporate governance, portfolio management and other aspects. It can be highly suitable for financial training and can systematically improve candidates’ theoretical basis and practical ability.

More importantly, the CFA exam already contains a lot of ESG content, such as financial report analysis, equity investment, fixed income, alternative investment, portfolio management and wealth planning, all of which include ESG investment integration-related learning content. Candidates can improve their professional ability by preparing for CFA exam, and at the same time learn various concepts of ESG knowledge, which is very important for practitioners who want to enter ESG industry and can effectively face practical challenges in the industry.

CFA Association, as a non-profit association of investment professionals, has the mission of leading the global investment industry and promoting high standards of ethics, education and excellent professionalism. So CFA certificate represents the global investment industry.The highest level and bound by the highest moral standards,Known as the "gold standard",It is similar to ESG’s emphasis on high moral standards and high social responsibility.This is also an important factor for major enterprises and institutions to favor CFA licensees.

As mentioned at the beginning of this paper, in today’s "cold wave" of employment, textual research has become one of the necessary options for financiers to broaden their career boundaries and explore the depth of their career development. With limited energy, it is even more important to get a good certificate and a certificate with high gold content and value.

For friends who want to transform into ESG-related fields in the financial industry, CFA certificate must be your best choice if you want to apply what you have learned, organically combine theoretical knowledge with business practice and be widely recognized by major enterprises and institutions.

* The above content does not constitute investment advice, and does not represent the viewpoint of publishing the platform. Users should consider whether any opinions, viewpoints or conclusions in this article meet their specific investment objectives, financial situation or needs. The market is risky, so you need to be cautious when investing. Please make independent judgments and decisions.

关于作者