[car home News] The 2016 Geneva Motor Show will kick off on March 1st (afternoon of March 1st, Beijing time). During the visit to the pavilion before the launch, our reporting team in front of car home photographed Peugeot’s new 2008, Kia K5 Travel Edition, BMW M760Li xDrive, Opel’s new Mokka X (domestic model is Buick Angola) and new DS 3. As an early spoiler of more than 80 new cars in this auto show, please enter this article to get a sneak peek.

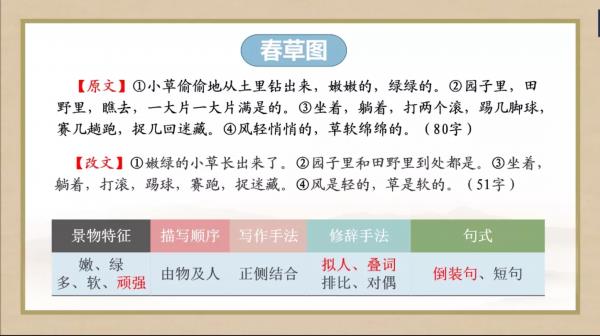

● Peugeot new 2008

From the appearance, the new Peugeot 2008 adopts a brand-new lattice air intake grille design, and moves the LOGO from the hood position to the center of the grille, making the new car look more fashionable. In addition, in the rear part of the car, the taillight group of the new car adopts a brand-new internal light cavity design and a family LED light source design, which makes the new car more recognizable.

In terms of power, the new Peugeot 2008 provides three 1.2T gasoline engines with different powers and three 1.6T diesel engines with different powers overseas. In terms of transmission, the engine will be matched with a 6-speed automatic gearbox.

Read more:

Geneva Motor Show Launches New Peugeot 2008 Official Map Released

//www.autohome.com.cn/news/201602/884839.html

● Ssangyong Tivera XLV

The appearance of Tivera XLV continues the design concept of XLV-Air concept car, with exaggerated front/rear bumper design, double waistline and suspended roof appearing on the new car. In addition, the new car has been lengthened by 235mm from the C-pillar, and the extra space makes the new car equipped with a third row of seats, and the luggage compartment space has been expanded to 720 liters.

Tivera XLV will provide 1.6L gasoline engine and 1.6T diesel engine for consumers to choose from, matching with a six-speed manual or automatic gearbox. In addition, the new car will also provide two different driving forms: front-wheel drive and four-wheel drive.

Read more:

Geneva Motor Show unveiled two new cars of Ssangyong.

//www.autohome.com.cn/news/201602/884711.html

● KIA K5 Sportswagon Travel Edition

『K5 Travel Sports Edition "

Kia K5 travel is consistent with the design style of K5 sedan version, and as a station wagon, the trunk with large load is the focus. According to the data, the trunk of K5 Travel Edition has a volume of 553 liters, and the rear seats can be laid down according to the ratio of 4/2/4, thus further expanding the available space. There are hooks and slide rails in the trunk to facilitate the fixation of articles, and there is a hidden storage compartment under the floor, which is more practical than the sedan version.

In terms of power, the fashion version will be equipped with a 2.0L SVVT naturally aspirated gasoline engine and a 1.7L CRDI diesel engine, of which the maximum power of the gasoline engine is 163 horsepower and the maximum power of the diesel engine is 141 horsepower. The transmission system will be available with manual and 7-speed powershift. The sports version will be equipped with a 2.0T turbocharged engine with a maximum power of 245 HP and a 7-speed powershift.

Read more:

Geneva Motor Show Debuted KIA K5 Travel Edition Official Map Released

//www.autohome.com.cn/news/201602/884813.html

● New DS 3

In the appearance part, the new DS 3/DS 3 convertible version is mainly modified for the front face shape, and the new car adopts the latest brand LOGO of DS brand. In addition, the two cars are also equipped with LED headlights, wheels with new shapes and more body colors for consumers to choose from.

In terms of power, the two cars are equipped with a 1.6L naturally aspirated engine in addition to the power equipment of the old models. They also add a sports version, which is equipped with a 1.6THP engine with an output of 211 horsepower. At the same time, the new car is also equipped with a sports suspension, and the height of the car is reduced by 15 mm.

Read more:

Positioning the official map of the pure electric sports car DS E-Tense concept car

//www.autohome.com.cn/news/201602/885173.html

● Peugeot Traveler/Citroen SPACETOURER

Peugeot TRAVELLER’s front face incorporates Peugeot’s latest family-style front face design. The star-shaped net has a very three-dimensional visual sense, and the headlights on both sides are very exquisite. As a light passenger car, the overall line of the new car is very straight and looks square.

This time, PSA cooperated with Toyota to launch Peugeot TRAVELLER, Citroen SPACETOURER and Toyota PROACE. Then the front face of Citroen SPACETOURER we saw added some design elements of Citroen brand, while the side and tail designs were consistent with the other two models. At present, the news about new cars is very limited, and we will continue to pay attention to it.

Read more:

Peugeot/Citroen/Toyota three commercial MPV official maps released.

//www.autohome.com.cn/news/201512/882388.html

● BMW M760Li xDrive

Unlike the normal version, the BMW M760Li xDrive is equipped with a series of aerodynamic kits, including a new style of front bumper and rear luggage compartment lid spoiler. In addition, the new car is equipped with a brand-new type of wheel rim, and the front and rear tyre size are 245/40 R20 and 275/35 R20 respectively.

In terms of power, the new car is equipped with a 6.6L V12 two-wheel supercharged engine, with a maximum output of 600 HP (441kW) and a peak torque of 800 N m. The transmission part is matched with an 8-speed automatic gearbox. With the assistance of the four-wheel drive system, it only takes 3.9 seconds for the car to accelerate from standstill to 100km/h, and the top speed is 250km/h (the top speed can reach 305 after the M driver’s suit combination is selected). ), the comprehensive fuel consumption is controlled at 12.6L/100km.

Read more:

Four new cars BMW 2016 Geneva Motor Show lineup exposure

//www.autohome.com.cn/news/201602/885019.html

● BMW i3 MR Porter Limited Edition

MR Porter is a British shopping website specializing in high-end fashionable men’s wear. Brands such as Gucci and Burberry that we are familiar with are all stationed in the website, and BMW i3 MR Porter Limited Edition adopts the color matching design with the theme of men’s wear style. Among them, the main body of the car body is painted with bright blue paint, supplemented by white air intake grille frame and white reflector shell. In addition, the new car is also printed with MR Porter logo and white waistline on the front fender.

In terms of power, the new car will be equipped with the same power system as the current BMW i3. The new car is equipped with a motor with a maximum power of 170 HP and a peak torque of 250 Nm, which is powered by a set of 22 kW lithium-ion batteries. Officially, the 0-100km/h acceleration time of the new car is 7.2 seconds and the maximum cruising range is 160 km.

Read more:

Unique color matching style BMW i3 limited edition official map released.

//www.autohome.com.cn/news/201602/884764.html

● Opel’s new Mokka X (four-wheel drive)

The new Mokka X adopts a brand-new lattice air intake mesh design and is equipped with a single chrome grille. The headlight group adopts LED adaptive headlight technology, which makes the new car look more exquisite with double banner daytime running lights. In addition, the car’s highly linear front bumper continues the family-style design style and looks very dynamic.

In terms of power, the new car is equipped with a 1.6L diesel turbocharged engine and a 1.4L direct injection turbocharged engine, of which the latter has a maximum power of 152 HP. In terms of transmission, the engine will be matched with a 6-speed manual transmission and a 6-speed automatic transmission. In addition, the new Mokka X will also be equipped with a four-wheel drive system.

Read more:

Geneva Motor Show unveiled Opel’s new Mokka X official map.

//www.autohome.com.cn/news/201602/884564.html

● Mitsubishi L200 GEOSEEK concept/ASX Jinxuan GEOSEEK concept Concept Car

In terms of appearance, the bodies of the two concept cars are all painted with unique pearl gray paint, and the front air intake grille and rims are treated with black. In order to further create a personalized visual effect, the two cars incorporate orange elements into the front fog lamp frame, the exterior rearview mirror shell, the roof rack, the wheel eyebrows and the rims.

In terms of equipment, both concept cars are equipped with roof luggage frames, in which the L200 GEOSEEK concept will provide a set of roof lighting that can be manually installed on the vehicle, while ASX Jinxuan GEOSEEK concept has upgraded the front fog lights and adopted a higher brightness LED light source. At present, the power configuration of the two concept cars has not been officially announced. According to previous reports, the powertrains of the two cars may follow the current production models. Among them, the current overseas version of ASX Jinxuan is equipped with 2.0L and 2.4L naturally aspirated engines, while the L200 is equipped with two kinds of adjusted 2.4T diesel engines.

Read more:

Create official maps of two Mitsubishi concept cars for outdoor people

//www.autohome.com.cn/news/201602/885060.html

● Mercedes -AMG C 43 Coupe

Different from the official map released before, the real car photographed this time is painted with black body, which cooperates with the two-color multi-spoke wheels to make the sense of movement of the whole car more prominent. At the same time, the car is equipped with a more radical body kit, and there are also enlarged vents on both sides of the front bumper.

In terms of power, the new car is equipped with a 3.0L V6 twin-turbo engine with a maximum power of 367 HP and a peak torque of 520 Nm. The transmission system is matched with a 9-speed automatic transmission. At the same time, the car is also equipped with a four-wheel drive system, with an acceleration time of 4.6 seconds from 0 to 96 km/h and a top speed of 249 km/h.

Read more:

Add AMG kit Mercedes-Benz new A 250 Sport official map

//www.autohome.com.cn/news/201602/885142.html

● Modern IONIQ

Hyundai IONIQ is a new energy vehicle launched by Hyundai, which has three power types: hybrid, pure electric and plug-in hybrid. Previously, Hyundai released its hybrid version, and this time we saw two circular holes on the left side of the car. It is expected that the front fender is the charging interface, while the back is the gasoline filler, showing its plug-in hybrid version. Exclusive identity.

Judging from its overall design, modern IONIQ is still relatively avant-garde, and the body lines and some details look full of technology. At present, there are not many news about the plug-in hybrid version of modern IONIQ. More news will be brought to you at the auto show.

Read more:

The cruising range is 169km. Modern IONIQ pure electric version official map.

//www.autohome.com.cn/news/201602/885012.html

● Rinspeed new concept car Etos

In terms of appearance, although the new car is based on the BMW i8, it has been completely redesigned. Except for the headlight group, it is difficult to see its similarities with the i8, and the rear of the new car has been completely redesigned, which looks even more exaggerated. In addition, the new car is also designed with a drone above the rear of the car. The photos and videos taken by the drone are posted on the network for sharing and so on.

In terms of technology, the new car also has the functions of wireless charging of smart phones, remote starting and unlocking of intelligent key, personalized charging, etc. In terms of power, the new car is equipped with a plug-in hybrid system, which is expected to be consistent with the BMW i8.

Read more:

Geneva motor show 2015: Rinspeed Budii concept car

//www.autohome.com.cn/news/201503/863019.html

● nanoFLOWCELL new Quantino concept car

Compared with the previously released models, the new models have basically not changed in appearance design, but only changed to yellow body color. However, it is reported that the new car will be equipped with a powertrain that is closer to mass production.

For reference, the old Quantino concept car is a pure electric vehicle with 2+2 design, and uses the flow battery technology to drive four motors. It is reported that the comprehensive maximum power output of the car can reach 136 horsepower, and it can realize four-wheel drive. The official said that the cruising range of the new car is above 1000km.

Read more:

In March, Geneva released the official map of new Quantino concept car.

//www.autohome.com.cn/news/201602/884543.html

● BMW M4 Competition Kit Edition

The BMW M4 competition kit version uses a black grille, personalized 20-inch multi-spoke wheels, and is surrounded by a sporty body. The overall effect is very dynamic. The new car will be equipped with new shock absorbers, anti-roll bars and a re-adjusted dynamic stability system.

In terms of power, the car will be equipped with a tuned 3.0L twin-turbocharged inline six-cylinder engine, and the maximum output power will be increased by 19 HP to 450 HP, and the performance will be improved.

Read more:

BMW M3/M4, which can improve 19 horsepower, introduces new options.

//www.autohome.com.cn/news/201512/883399.html

● smart forfour BRABUS

Smart forfour BRABUS is based on the ordinary model, and its body adopts a newly designed kit. The style of the front bumper is exactly the same as that of the previously released smart fortwo BRABUS, and we can also see that it adopts a brand-new multi-spoke wheel rim.

In terms of power system, the new car will be equipped with a 0.9TCe three-cylinder turbocharged engine, and its maximum output power can reach about 120 to 130 horsepower, which is nearly 30 horsepower higher than that of the ordinary 0.9T model.

Read more:

The first exposure of smart forfour BRABUS spy photos in March

//www.autohome.com.cn/news/201512/883399.html

● Volkswagen POLO beats Special Edition

The design of the Volkswagen POLO beats Special Edition will not be particularly changed from the current POLO, but the new car will adopt a unique air intake grille and exterior rearview mirror shell material, and will be equipped with brand-new 16-inch wheels.

We didn’t photograph the interior of this car at the scene, but according to the information we have learned before, the car will adopt unique seats and interior panels, and it will be equipped with beats sound including 7 speakers and a subwoofer. The power of this sound reaches 300 watts.

Read more:

With a 300-watt stereo, Volkswagen will push the special edition of POLO beats.

//www.autohome.com.cn/news/201602/885149.html

● Volvo V90

At the scene, the Volvo V90 body is still wrapped in camouflage, and we can only see the design of the second half. However, we can still see that the lines of the new car are straight, the design of the taillights is very individual, and in addition, it also uses multi-spoke wheels.

Volvo V90 has been officially released in Stockholm before, and this exhibition is the first time to be exhibited to the public. In terms of power, this car will be equipped with a 2.0L turbocharged engine, a 2.0L mechanical+turbocharged engine, a 2.0T plug-in hybrid system and a diesel engine.

Read more:

"Majestic" Volvo V90 wagon is the world premiere

//www.autohome.com.cn/news/201602/884842.html

● Ford Vignale version

As early as the second half of 2015, Ford expressed its intention to launch the Vignale version of its models. The Vignale version is a luxury version based on the current models built by Ford for the European market. This version of the model will incorporate more luxurious decorations and configurations in the appearance and interior of the car body. At this year’s Geneva Motor Show, we also saw real cars, including Mondeo, Sharp and other models that have been reported before.

Judging from the situation we photographed at the scene, the Vignale version has covered many main models of Ford, and the higher configuration is the biggest highlight. However, since the car will only be put on the European market, domestic consumers may not be able to enjoy this special version for the time being.

Read more:

Geneva Motor Show Releases More Vignale Ford Models

//www.autohome.com.cn/news/201602/885148.html

● BMW i8 Proton Red Edition

At the beginning of February this year, BMW released the official map of BMW i8 Protonic Red Edition, and said that it will be officially released at this Geneva Motor Show. In July this year, it began to produce in a limited edition mode. Now this car has officially arrived at the Geneva Motor Show, and we also took photos of the real car during the museum visit.

This special edition car mainly focuses on the appearance and interior color matching, but in terms of power, the car is nothing special. It is completely consistent with the current i8, equipped with a plug-in hybrid system, consisting of a 1.5T three-cylinder turbocharged engine and an electric motor.

Read more:

New color matching i8 Protonic Red Edition official map

//www.autohome.com.cn/news/201602/884674.html

● BMW M2 M Performance

During the visit to the Geneva Motor Show, we also photographed the BMW M2 M Performance Suite. Compared with the ordinary version, the new car adopted a sports kit derived from racing style.

In terms of power, the new car is still equipped with a 3.0T inline six-cylinder engine with a maximum power of 370 HP and a maximum torque of 464 Nm. As for transmission, we will continue to pay attention to the official release information of the car after the opening of the auto show.

Read more:

In April, BMW M2 was listed at Beijing Auto Show or sold for 628,000 units.

//www.autohome.com.cn/news/201602/884859.html

● Bentley New Mu Shang

Due to the site conditions, we only photographed the side of this car. It is reported that the new Mu Shang will launch long-wheelbase versions of Mu Shang, Mu Shang Speed and Mu Shang, in which the wheelbase of the long-wheelbase version has been lengthened by 250mm, reaching 3516mm, and the extended space has basically been given to the back row.

In the power part, the new Mu Shang regular version and the long wheelbase version are equipped with a 6.8T V8 engine, which has a maximum power of 512 HP and a peak torque of 1020 Nm, matched with an 8-speed automatic gearbox from ZF. Mu Shang Speed is equipped with a 6.8T V8 engine, with a maximum power of 537 HP and a peak torque of 1,100 n m. The time from 0 to 1100N·m/h is 4.9 seconds and the top speed is 305 km/h..

Read more:

The official map of Bentley’s new Mu Shang was released at the Geneva Motor Show

//www.autohome.com.cn/news/201602/885052.html

● Volkswagen’s new up!

During the visit, we saw Volkswagen’s new up! Model, in addition to minor adjustments in appearance, the car is also equipped with a brand-new 1.0TSI engine.

In terms of power, the new car will be equipped with a brand-new 1.0TSI gasoline engine, with a maximum power of 90 HP and a peak torque of 160 Nm, an increase of 15 HP and 65 Nm compared with domestic models on sale. According to the official, the 0-100km/h acceleration of the new car will be within 10 seconds, and the top speed will be 185km/h, while the comprehensive fuel consumption of the new engine is only 4.4L/100km.

Read more:

Equipped with the new 1.0TSI engine, the new Volkswagen up! Official map

//www.autohome.com.cn/news/201602/884998.html

● Porsche 718 Boxster

Earlier, Porsche officials announced that they would terminate the research and development of the new entry-level Porsche 718, but then some media reported that Porsche would not give up the name of "718", and Porsche Boxster and Cayman would be sold in the market under the name of "718" in the future. With the arrival of the Geneva Motor Show, we also saw the real 718 Boxster at the first time.

In addition, the biggest feature of the Porsche 718 series is that it will be equipped with a four-cylinder turbocharged engine. According to foreign media, the entry-level Porsche 718 will be equipped with a 2.0L four-cylinder engine with a maximum power of 240 HP. In addition, the new car will be equipped with a 2.5L four-cylinder turbocharged engine, and two different adjustments will be provided. The maximum power will reach 300 HP and 370 HP respectively.

Read more:

Official map of Porsche 718 Boxster with four-cylinder engine

//www.autohome.com.cn/news/201601/884283.html

● Lotus Elise Cup 250

As the fastest Elise model, Elise Cup 250 will adopt a brand-new aerodynamic kit, new lightweight rims, lightweight lithium-ion batteries and carbon fiber seats. In addition, the new car can be further equipped with carbon fiber component package, and the weight of the new car can be reduced by about 10 kg after the option.

In terms of power, the new car will still be equipped with a 1.8T supercharged engine with a maximum power of 246 HP and a peak torque of 250 Nm. In terms of transmission system, it is still matched with a 6-speed manual gearbox. It is reported that the 0-96km/h acceleration time of this car is within 3.9 seconds, and the maximum speed can reach 248 km/h.

Read more:

246 horsepower Lotus released Elise Cup 250 official map.

//www.autohome.com.cn/news/201602/884770.html

● Kia Niro

Niro adopts KIA family-style "Tiger Whistling" front air intake grille, the interior of polygonal headlights adopts lens design, and there are two vertical vents on both sides of the front bumper, which is very sporty. The side lines are compact, and the upper edge of the window has chrome trim, and the black wheel eyebrows and anti-scratch strips complement each other.

In terms of power, KIA Niro adopts a hybrid power form of 1.6L "kappa" four-cylinder engine and motor, in which the rated power of the engine is 103 HP and the motor is 43 HP. It is reported that this 1.6L "kappa" engine carried by Niro adopts Atkinson cycle technology, which has excellent performance in fuel consumption; The motor is powered by a 1.56 kWh lithium battery pack. The combined maximum power of this power combination is 146 HP and the maximum torque is 264.Niumi. The transmission system adopts 6-speed powershift. In addition, Niro will be equipped with a four-wheel drive system.

Read more:

Kia Niro officially unveiled with hybrid system

//www.autohome.com.cn/news/201602/884702.html

● Jaguar F-TYPE SVR

Compared with the ordinary version, the new car is equipped with a more sporty body kit, which includes a front bumper/hood with a large air inlet, a rear spoiler that can automatically rise with the speed change, a titanium alloy exhaust system with four sides, a 20-inch forged rim and Pirelli P Zero tires.

In terms of power, Jaguar F-TYPE SVR is equipped with a 5.0L V8 supercharged engine with a maximum output of 575 HP and a peak torque of 700 Nm, which is 24 HP and 20 Nm higher than the current Jaguar F-TYPE 5.0T R four-wheel drive hardtop model, respectively. The transmission system is matched with an 8-speed automatic manual transmission and a four-wheel drive system. In addition, Jaguar engineers equipped the car with a high-performance braking system, a rear axle electronic differential and a sports suspension system with adaptive shock absorbers.

Read more:

In March 2016, he appeared in Jaguar F-TYPE SVR convertible spy photos.

//www.autohome.com.cn/news/201510/880441.html

● Rimac Concept One production version

Not long ago, we reported the official production version of Rimac Concept One, an electric supercar owned by Croatian supercar brand Rimac, and the car has now officially arrived at the Geneva Motor Show. If it is as previously exposed, the car will have up to 1,000 horsepower output.

In terms of power system, the car is driven by an 82 kWh battery to drive four motors located in the center of the front and rear axles. This system can generate the maximum power of 1088 HP and the maximum torque of 1600 Nm. The acceleration time of 0-100km/h is 2.6 seconds, the acceleration time of 0-200km/h is 6.2 seconds, and the top speed can reach 355 km/h. According to the official statement, the Rimac Concept One electric supercar will be limited to 8 cars.

Read more:

Geneva Motor Show unveiled Rimac electric supercar official map

//www.autohome.com.cn/news/201602/885021.html

● RenaultQuanxin scenery

The new landscape adopts the design lines of the R-Space concept car, and the front grille of the new car adopts a single-banner grille with a black mesh design and is connected with the headlight group. The new body shape looks very streamlined, and the personalized two-color body design with two-color sports wheels and chrome-plated decorative parts on the side also makes the new car look more fashionable.

The new landscape will be built based on the CMF platform, and the new Megane was born on this platform, so the new landscape will share part of the powertrain with the new Megane in the future. We will continue to pay attention to more information after the official opening of the auto show.

Read more:

In March 2016, Renault’s new big landscape spy photos were exposed.

//www.autohome.com.cn/news/201512/883061.html

● Subaru XV Concept car

The front bumper of the new car has a strong cross-border style, which adopts a larger front bumper lower guard plate and L-shaped air inlets on both sides. The front face of the car still uses the Subaru family-style front air intake grille, and the C-shaped headlights design looks quite sharp. In addition, Subaru also equipped the new car with a brand-new aluminum alloy rim, and the color matching of orange and black is very individual.

Subaru’s new generation XV will be built on the same modular platform as the new impreza. The wheelbase of the new Impreza concept car is 2.67 meters, which is similar to the Subaru XV Concept concept car. At present, the power information about the car is limited, and we will continue to report more details after the opening of the auto show.

Read more:

March will be unveiled at Subaru XV Concept preview.

//www.autohome.com.cn/news/201602/884642.html

● hacker Premium Concept

Hacker Premium Concept is painted in sub-light color, and copper color will be painted on the rim, roof rack, front bumper and other parts. In addition, this car will use carbon fiber components in many parts.

Nissan launched this car mainly to celebrate the success of the hacker model in the European market, but at present, Nissan has not announced the details of this car, and we will bring you detailed reports after the opening of the auto show.

Read more:

On March 1 ST, he appeared in the official map of hacker/Qijun customized concept version.

//www.autohome.com.cn/news/201602/885096.html

● Volvo’s new V40

Due to the limitation of conditions, we only photographed some details of the new car. As can be seen from the photos, the front air intake grille of the new car adopts a vertical design, which is quite different from the transverse type of the current model. In addition, the headlights of the new car adopt Raytheon hammer headlights commonly used in new Volvo models, or adopt full LED light sources.

There is little difference between the interior and the current model. The model in the photo adopts beige and black two-color interior, and the steering wheel also adopts two-color stitching color matching. According to previous official news, the new V40 will have a variety of options in the material selection of interior trim strips.

In the power part, Volvo’s new V40 is expected to continue the power system of the current model, equipped with 1.5T and 2.0T turbocharged gasoline engines, matching the 6-speed automatic manual transmission; In Europe, a 2.0T four-cylinder turbocharged diesel engine will be launched.

Read more:

Geneva Motor Show Releases Volvo’s New V40 Official Map Exposure

//www.autohome.com.cn/news/201602/885080.html

● Lexus LC 500h

Lexus LC is a brand-new sports car product, which is the first product created by Lexus’ new rear-drive platform (GA-L). The traditional gasoline version (LC 500: 5.0L+10AT) was released in north american auto show, and a hybrid version will be launched at the Geneva Motor Show which opened on March 1st. The LC 500h is equipped with a hybrid system, which consists of a V6 engine (or 3.5L) and an electric motor. The comprehensive maximum power is 359 horsepower, and the acceleration time from 0 to 100 km/h is less than 5 seconds.

The transmission system of the car is also a bright spot. The LC 500h adopts a compound transmission system, and adds a 4-speed automatic gearbox on the basis of the electromechanical coupling device (E-CVT) with planetary gear structure, which can simulate 10 gears and has M pure manual mode. The newly designed motor is lightweight and miniaturized, and the front-to-rear weight ratio of the car body is 51:49.

In terms of interior, the interior of the car is arranged with the driver as the center, and the interior uses a variety of colors, with outstanding visual effects. The LC 500h comes standard with Lexus intelligent safety system LSS+. The main functions of LSS+ include pre-collision system (PCS), adaptive cruise control system (ACC), lane departure warning system (LDA) and high beam automatic control system (AHB). In addition, the second collision braking system (SCB) and emergency braking reminder system (ESS) are added to the vehicle.

Read more:

"Break 100" Lexus LC 500h information in 5 seconds

//www.autohome.com.cn/news/201602/884840.html

● Qijun Premium concept car

The appearance of Qijun Premium concept car is painted with matte white body, but its engine compartment cover and roof are made of carbon fiber, and the visual effect is very unique. In addition, the new car is also equipped with a bronze front bumper lower guard plate and side skirts. The four-wheel wheel eyebrows are treated with high-gloss black, and the front bumper is also equipped with LED daytime running lights.

However, at present, the official has not released the power system of the new car. We still need to wait for the official opening of the Geneva Motor Show, and Nissan will officially release more information about the car, and we will continue to pay attention.

Read more:

On March 1 ST, he appeared in the official map of hacker/Qijun customized concept version.

//www.autohome.com.cn/news/201602/885096.html

● Lotus Exige 350

The new car adopts two-door convertible design, the yellow paint on the body is very bright, and the gray paint on the A-pillar is used, which has outstanding visual effect. The side lines of the new car are smooth, and the rear of the car door is equipped with a large air inlet. The large black rim is very harmonious with the car body.

The tail line of the new car is relatively straight, and the four-round taillights keep the tradition of Lotus. The tail of the new car is equipped with a large-size tail diffuser and a central exhaust system, which is full of fighting atmosphere. In terms of power system, the new car is equipped with a 3.5L six-cylinder engine with a maximum power of 350 HP and a maximum torque of 400 Nm. In terms of transmission system, the new car will be equipped with a manual gearbox and an optional 6-speed automatic gearbox. According to the official, the acceleration time of 0-100km/h of the new car manual transmission model is 3.9 seconds, and that of the automatic transmission model is 3.8 seconds.

Read more:

Geneva Motor Show Debut Lotus will launch two new models.

//www.autohome.com.cn/news/201602/885076.html

● Arash AF10

The new AF10 has the appearance of a typical super sports car. The low body, gull-wing doors, large-size rear spoiler and other elements can be seen in the new car. The car body and cockpit are made of carbon fiber materials in a large area, which will achieve the ultimate lightweight. The weight of the car body is about 1260kg.

In terms of power, the new AF10 adopts a hybrid form of 6.2 V8 engine and four independent motors. Officially, this hybrid system can output a maximum power of 2,080 HP and a maximum torque of 2,280 Nm. In addition, the new car adopts a four-wheel drive system, and the transmission system is a 6-speed manual or automatic gearbox. The top speed of the new car is limited to 323km/h, and the acceleration time of 0-100km/h is less than 3 seconds.

Read more:

Geneva Motor Show Debut Arash New Super Run Official Map Released

//www.autohome.com.cn/news/201602/884898.html

● Ferrari GTC4Lusso

From the appearance, the new car adopts the latest design language of Ferrari family, and the front face looks softer than FF. In addition, the new car also adopts a brand-new aerodynamic design, which looks more streamlined.

In the rear part, the new taillight group adopts the traditional four-circle taillight group design, and the brand-new bottom spoiler and bilateral four-exhaust look particularly exaggerated. In addition, according to official sources, Ferrari GTC4Lusso has added rear wheel steering technology.

In terms of power, the Ferrari GTC4Lusso is still powered by a naturally aspirated V12 engine. However, after adjustment, the maximum output power of the engine is increased to 689 HP (507kW) and the peak torque is 697N·m, which is 29 HP and 14N·m higher than that of FF. In terms of performance, it takes only 3.4 seconds for Ferrari GTC4Lusso to accelerate from standstill to 100km/h, which is 0.3 seconds less than the current one, and the top speed is still 335 km/h.

Read more:

Official map of "FF successor" Ferrari GTC4Lusso released

//www.autohome.com.cn/news/201602/884626.html

● Arash AF8 Cassini

In terms of appearance, the new car uses a yellow and black body. The front face design is somewhat different from that of the AF10. It looks less fierce, but the whole is also very dynamic.

In terms of power, the AF8 Cassini will be equipped with a 7.0L V8 engine, with a maximum power of 557 HP and a maximum torque of 645 Nm. The transmission system is matched with a 6-speed manual gearbox, which takes 3.5 seconds to accelerate for 100 kilometers and the top speed can reach 315 km/h.

Read more:

Geneva Motor Show Debut Arash New Super Run Official Map Released

//www.autohome.com.cn/news/201602/884898.html

● Citroen C4 Cactus Rip Curl Edition Special Edition

From the point of view of the real car, the side shape of the car basically continues the design of the ordinary version. The difference is that the new car has a special version of exclusive lace on the front fender and D-pillar, and the exterior rearview mirror and roof rack are also integrated with white elements different from the whole car body.

"Official Map of Citroen C4 Cactus Rip Curl Edition Special Edition"

In terms of power, the new car is equipped with a Puretech 110s & s gasoline engine or a BlueHDi 100 diesel engine, and the transmission systems are all manual gearboxes. The new car will be equipped with driving mode options, including standard, gravel, off-road, snow and turning off the electronic stability system.

Read more:

Official map of Citroen E-MEHARI concept car with convertible electric car

//www.autohome.com.cn/news/201602/885280.html

● Koenigsegg Agera RS

The appearance looks competitive, and the body and aerodynamic kit are made of carbon fiber, which has not changed much compared with Agera RS released at the last Geneva Motor Show. This supercar is more like a big toy. When you open the back cover, you can see the suspension and other parts besides the engine, which completely integrates the racing concept into this highway supercar.

At present, no more information about this car has been obtained. The body mass of the 2015 Agera RS is 1395kg, and it uses a 5.0L engine with a maximum power output of 1160 HP and a peak torque of 1280 N m. For more data about this car, we will give you a detailed report when it is officially launched.

Read more

2016 Geneva Motor Show: C4 Cactus Special Edition

//www.autohome.com.cn/news/201602/885322.html

● Citroen E-MEHARI concept car

Different from the previously exposed official map, the on-site E-MEHARI concept car is painted in more vivid red, and its A-pillar is painted in white. It is reported that the car was jointly built by Citroen and the famous French clothing brand Courreges. The car has a four-seat layout and has a convertible body structure.

"official map of Citroen E-MEHARI concept car"

In terms of power, the E-MEHARI concept car is driven by pure electric power, and its motor has a maximum output of 68 HP, matching with a 30kWh battery pack, with a maximum cruising range of 200 km and a top speed of 110 km/h. In terms of charging time, it can be fully charged in 8 hours in fast charging mode and 13 hours in slow charging mode.

Read more:

2016 Geneva Motor Show: Citroen DS 3 debut

//www.autohome.com.cn/news/201602/885244.html

● New DS 3 convertible performance version

From the point of view of the real car, the whole body of the new car is painted in matte black, and the diameter of the new multi-spoke aluminum alloy rim is increased, and its tail is also equipped with an exhaust system with single side and double output. Compared with the ordinary version, the overall sense of movement is improved obviously.

As a key point, the car’s power system is equipped with a 1.6THP engine with a maximum output of 211 HP. At the same time, the new car is also equipped with a sports suspension, and the height of the car is reduced by 15 mm.

Read more:

Positioning the official map of the pure electric sports car DS E-Tense concept car

//www.autohome.com.cn/news/201602/885173.html

● Bentley flying V8 S

Externally, we can see that in addition to maintaining the family-style design concept, Bentley Speeding V8 S has richer front lines and adds some sporty atmosphere. The V8 S logo is added near the C-pillar, and the diameter of the six-spoke rim is 20 inches, which makes the shape more dynamic. In addition, there are some options available, including 21-inch Mulliner Driving Specification two-color six-spoke wheels and blackened taillights.

In terms of power, the Feichi V8 S is powered by a 4.0-liter twin-turbo engine with a maximum power of 528 HP and a peak torque of 680 Nm. This recalibrated engine is 21 horsepower and 20 Nm higher than the current Flying V8. The transmission part is matched with an 8-speed automatic gearbox, and the acceleration of 0-100km/h can be completed in 4.9 seconds, and the top speed reaches 306 km/h.

Read more

2016 Geneva Motor Show: Agera RS exposure

//www.autohome.com.cn/news/201602/885323.html

● Ssangyong SIV-2 concept car

In appearance, although most of the car body is covered by tarpaulin, we can still see from the front face that the lower part of the front bumper is designed with trapezoidal multi-banner air inlets, and LED fog lamps are equipped on both sides of the bumper. On the tail side, the taillight group of the new car has a sharp shape, and chrome trim is used to connect the two sides of the taillight group. The lower part of the rear bumper has an exhaust system with two sides.

In terms of interior, the interior of the new car adopts a two-color treatment of light blue and white, and both sides of the center console are designed in a through way, and its instrument panel is suspected to be equipped with a full LCD display. In addition, the car is equipped with a three-spoke multifunctional steering wheel and a man-machine interaction system.

In terms of power, Ssangyong SIV-2 concept car adopts mild hybrid mode, equipped with a 1.5L direct injection gasoline engine and a 10kW motor, and equipped with a 0.5kWh lithium battery pack.

Read more:

2016 Geneva Motor Show: Shuanglong Tivera XLV

//www.autohome.com.cn/news/201602/885203.html

● McLaren 570GT

In terms of appearance, the 570GT has the same design as the 570S, and the details have been adjusted. It is equipped with a panoramic glass skylight, and SSF technology is used to further reduce solar radiation and external noise, and it has certain heat insulation effect. The weight of the whole vehicle is 1350kg. In the power part, the 3.8-liter V8 twin-turbo engine of the 570GT has a maximum power of 570 HP and a peak torque of 600 Nm. 0-100km/h acceleration time is 3.4 seconds.

Read more:

2016 Geneva Motor Show: Ssangyong SIV-2 Concept Car

//www.autohome.com.cn/news/201602/885327.html

● smart convertible Babos version

Different from the regular version, the whole body of the new smart fowtwo convertible Babos version is painted in matte blue, and its headlights and multi-spoke aluminum alloy wheels are blackened. In addition, the lower part of the rear bumper of the car is equipped with a dark lower guard plate.

In terms of power, the new car is equipped with an enhanced 0.9T three-cylinder turbocharged engine with a maximum power of 110-120 HP. At the same time, the new car will be driven by rear wheels, and its suspension and braking system will also be improved.

Read more:

Geneva Motor Show: smart forfour BRABUS

//www.autohome.com.cn/news/201602/885247.html

● McLaren 675LT Spider MSO Edition

It is reported that the McLaren 675LT Spider has sold 500 units worldwide, and all the cars have been sold out. In terms of appearance, the new car body is painted in a unique ceramic gray color, and the side skirts, side vents and front and rear bumpers are all made of carbon fiber. A 24K gold-plated exhaust hood is also installed at the titanium alloy exhaust at the rear of the car.

"official map of mclaren 675LT Spider MSO edition"

In terms of power, the 675LT Spider is equipped with a 3.8L V8 twin-turbo engine, with a maximum power output of 675 HP, and the 0-100km/h acceleration takes only 2.9 seconds.

Read more:

Panoramic skylight/March debut McLaren 570GT official map released

//www.autohome.com.cn/news/201602/885093.html

● Toyota PROACE

"The picture above shows the Toyota PROACE real car; The picture below shows the official map of Toyota PROACE.

From the aspect of appearance, Toyota PROACE front air intake grille adopts a chrome-plated single banner style, the headlight group is connected with it, and the interior is designed with LED daytime running lights. At the same time, the lower part of the front bumper of the car is designed with a trapezoidal air inlet, and both sides are equipped with round front fog lights. The overall front face is calm and atmospheric. At present, the power parameters of the car have not been officially announced, and we will continue to pay attention.

Read more:

Geneva Motor Show Debuted Toyota C-HR Official Map Officially Announced

//www.autohome.com.cn/news/201602/885193.html

● pagani Huayra BC

Huayra BC is based on Huayra Coupe, and its design is inspired by Zonda and Cinque. The design of the front enclosure is more competitive. In terms of details, the LED light source is added to the lower part of the front face and the English logo of Huayra BC is added.

In terms of power, Huayra BC is equipped with a 6.0T V12 engine from Mercedes -AMG, and the power data has not been released for the time being, which is higher than the current Huayra’s 730 horsepower and 1001 Nm. In terms of interior, Huayra BC has no updated design, adopts red/black color matching, and uses a lot of carbon fiber materials, which is full of competitive flavor.

Read more

2016 Geneva Motor Show: Toyota PROACE real car exposure

//www.autohome.com.cn/news/201602/885331.html

● spyker C8 PRELIATOR

From the appearance point of view, the front face of the new car still adopts the Spyker family-style oval front grille, and the interior of the grille is made of aluminum. The carbon fiber front lip at the lower part of the front bumper and the vents on both sides also indicate its strong performance. Viewed from the side, the new car has a slender proportion, smooth body lines and large-sized multi-spoke aluminum alloy wheels.

At present, the power parameters of spyker C8 PRELIATOR model have not been officially announced, but according to previous reports, the car is expected to be equipped with a pure electric system.

Read more:

A preview of a brand-new sports car named C8 PRELIATOR Spyker

//www.autohome.com.cn/news/201602/884648.html

● Peugeot I-Lab concept car

The exterior design of Peugeot TRAVELLER I-Lab concept car retains the style of Traveler, including the front face design with strong layering and personalized multi-spoke wheels. The difference is limited to the I-Lab sticker posted on the rear window of the new car.

The interior of Peugeot TRAVELLER I-Lab concept car is the main attraction. A 30-inch giant LCD screen is installed in the center of the seat, which can also be divided into four different areas for the rear passengers to use alone, and the rear row adopts a double-row opposite seat layout.

Peugeot TRAVELLER I-Lab concept car is still very rich in configuration, including road sign recognition system and driver monitoring system, which can help drivers drive according to the rules and avoid drivers’ distraction. In addition, this concept car will also be equipped with a new 3D navigation system.

Read more

2016 Geneva Motor Show: Preliator, spyker c8

//www.autohome.com.cn/news/201602/885333.html

● Full text summary:

According to our statistics, more than 80 new cars are expected to be launched at this year’s Geneva Motor Show, which can definitely be regarded as an annual feast of the automobile industry. Before the opening of the motor show, the reporting team in front of car home will continue to explore the pavilion. I believe that as the time is getting closer and closer to the official opening, more heavy models will be exposed, so this article will continue to be updated for everyone.

In addition, the Geneva Motor Show will kick off on the afternoon of March 1st, Beijing time, when we will bring you more detailed reports. (Text/car home Information Section)