One year after the layoffs, the Indian hotel chain OYO is ready to go public.

On October 1st, OYO formally submitted a prospectus to the Indian Securities and Exchange Commission (SEBI), with a target of raising about $1.2 billion and a valuation of $9 billion.

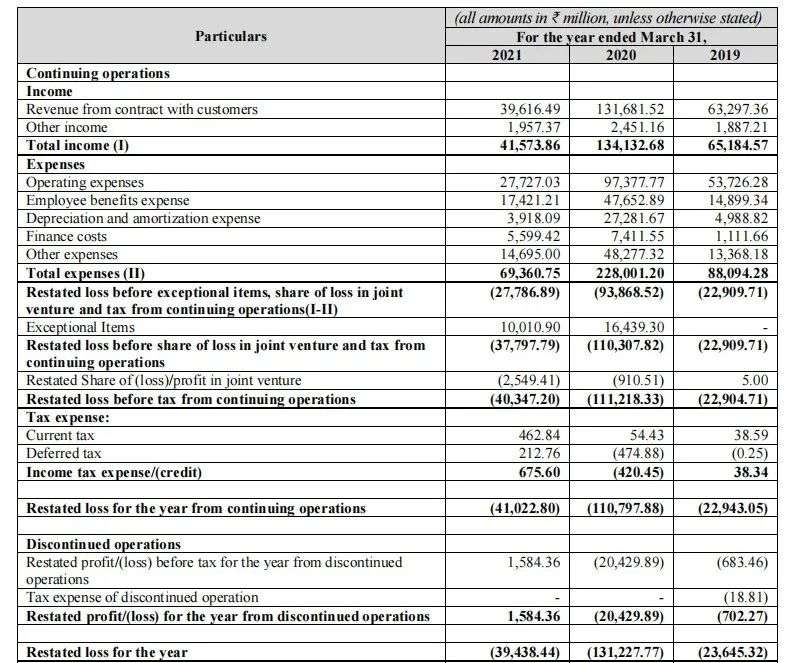

This hotel brand, which was highly praised by Sun Zhengyi, was once defeated in the China market. OYO, which is plagued by scandals such as massive layoffs, executives leaving, and declining reputation for service quality, still has a loss hole of $526 million in the prospectus submitted today. Looking back on its three years of market expansion in China, OYO had to "retreat" in a despondent way because it had not found a sustainable and profitable business model and a lot of complaints from domestic hotel owners and guests.

Nowadays, OYO is eager to go public, raising nearly $1.2 billion to make up for the loss loophole. However, this can only alleviate the temporary need, and according to the previous loss rate, it is only enough for two years.

Tracing the development history of OYO in China, we can find that its hematopoietic capacity has been questioned.

This Indian-born budget hotel chain, led by Ritesh Agarwal (Chinese name: Tae-Hee Lee), the founder of the post-90s generation, has had a smooth journey.

Since its establishment in 2013, OYO has completed 20 rounds of financing, with the total amount of financing exceeding 42 billion yuan. Among the investment institutions, Softbank Group, which has participated in seven rounds of financing, currently holds 46.62% of the shares and remains the largest shareholder of OYO.

Thanks to the capital, OYO’s overseas expansion has shown a rapid trend. It took only eight years to spread all over more than 30 countries around the world, and its number of stores exceeded 23,000 and the number of rooms exceeded 157,000, making OYO the third largest hotel chain brand in the world, and it was regarded as a super unicorn.

In 2017, OYO set foot on the journey of China market, adhering to the consistent high efficiency, covering 300 cities in China in one and a half years, and expanding the number of stores to 10,000. However, OYO, which has not yet gained a firm foothold, is facing an epidemic. The huge loss of $197 million forced OYO to temporarily give up the "big cake" of China.

Judging from the prospectus submitted this time, the loss problem of OYO has not been solved, and the operation mode and crazy expansion of "cutting meat" have caused OYO to fall into a hematopoietic dilemma. If this situation cannot be changed, Tae-Hee Lee’s trip to ring the bell will be suspended.

This super unicorn from India seems a little unaccustomed in China.

In March, 2020, OYO was exposed to the news of massive layoffs and the resignation of senior executives in China. First of all, the 11 regions in China will be merged into 7 regions, and the number of HUBs will be reduced from 48 to 30. The number of employees in the company has been reduced from 9,800 in 2019 to more than 2,700, and the reduction rate is as high as 72%.

At the same time, at that time, OYO’s seven VP/SVP members who participated in the early establishment of the China team had left five, and CXO members who joined later left three.

The number of OYO’s stores in China has suddenly decreased due to internal turmoil. According to AI Finance & Economics, there are only more than 3,500 stores in China, which is nearly two-thirds less than the peak period.

And OYO’s retreat from China seems to be a thunderstorm, but in fact it has a warning.

As early as June 2019, OYO began to promote the layoff plan. At that time, the layoff rate had reached 50%, many front-line operation teams were laid off, and several core executives including Xiaoming Fu and feng han also left their jobs one after another.

Combined with the financial report data released in February 2020, its loss amount expanded from $52 million to $335 million, of which China lost $197 million, accounting for more than 58%.

In addition, the service and quality of OYO-affiliated hotels have also been criticized by consumers in China, because most hotels were previously poorly run or had outdated facilities, and the service quality control could not be guaranteed. There are thousands of complaints about black cats, such as disputes among hotel owners, substandard hygiene and bad service attitude.

Nevertheless, OYO has not completely abandoned the China market. According to the prospectus, OYO included China and the United States in the list for evaluating future growth markets.

However, OYO, which has been labeled as layoffs and poor service quality, is still too early to return to the China market.

Judging from the prospectus, OYO is still at a loss stage.

As of the end of March this year, OYO’s revenue was about 534 million US dollars, with a loss of 526 million US dollars. Looking forward to the data of the two fiscal years, the revenue was $841 million and $1.749 billion, respectively, while the loss reached $315 million and $1.745 billion, respectively, and the total loss in the three fiscal years was about $2 billion.

The loss is expanding, but the revenue is decreasing, which makes people doubt OYO’s hematopoietic capacity.

According to the prospectus, the main source of OYO’s revenue at present is the sale of accommodation services, which is its old bank’s "OEM" service. As a hotel chain platform, OYO does not participate in building hotels and buying hotels, but chooses to let hotels join in, carry out unified transformation and management for them, and does not charge franchise fees, so as to expand its stores.

It can be seen from the domestic development track that OYO has not yet explored a sustainable and profitable business model.

In the initial stage of expansion, OYO launched the 1.0 version of the light asset joining model. In order to attract hotel owners to join OYO, the expected profit is usually falsely reported. For example, for a hotel with a maximum of 1.5 million yuan at the peak of the year, the brand salesman usually puts forward a guaranteed amount of 2 million yuan/year to the hotel owner.

In order to achieve this false high traffic data, hotels will make use of the management loopholes of early manual order entry to falsify the number of orders. According to the previous report of Zinc Finance, some interviewees directly said that "once the owner told the front desk in front of me how many orders only needed to be entered, and there was no need to record them after that".

After the launch of the 2.0 model, OYO will optimize the sharing model, and the guaranteed income will share risks and benefits according to the hotel’s past income. However, the strong management mechanism of this model soon intensified the direct contradiction between the platform and the hotel owners. Under the 2.0 mode, OYO has independent and safe pricing power for hotels. In order to improve the off-season occupancy rate, OYO has forced many hotel owners to become "suckers" to bear the losses.

Regardless of the 1.0 or 2.0 model, OYO has never given a reasonable business model, which has also made it lose ground in the China market.

After OYO withdrew from the China market, although the loss decreased, it still existed. In the final analysis, it was due to the business model. The model of sharing risks and benefits is difficult to adapt to the market. Coupled with the competitive pressure in the hotel chain market, OYO’s desire to return to the China market may be just empty talk.

This article is from WeChat WeChat official account "Zinc Finance" (ID: xincaijing). Author: Hu Yutong, authorized by 36Kr.

关于作者