I. Preface

Under the fixed tone of "giving priority to the recovery and expansion of consumption", online retailing, which is influenced by Internet penetration and the rise of "home economy", occupies an increasingly important position.

This year’s government work report pointed out that in the past five years, the proportion of online retail sales of physical goods in China’s total retail sales of consumer goods increased from 15.8% to 27.2%. In the rapid growth of nearly doubling, instant retailing with high convenience and timeliness, as an important part of O2O(Online To Offline) home business, has become one of the main engines of new retail in recent years, and is also regarded as the key track of new retail and the blowing "window".

The "Report on the Development of Online Retail Market in China in 2022" released by the Department of Electronic Commerce and Information Technology of the Ministry of Commerce on February 20th this year proposed that the industries and categories of instant retail penetration will continue to expand in the future, covering more application scenarios. In 2023, the Ministry of Commerce will launch a three-year action plan, comprehensively promote the construction of a convenient living circle, promote new online and offline integration models such as online booking and instant retail, and create a new engine for consumption growth.

Second, the definition of instant retail

As the name implies, instant retail is the core, which refers to a new retail format that connects local retail supply and meets consumers’ immediate needs through instant logistics performance. It contains three core elements — — Immediate demand, local supply, immediate performance.

By definition, instant retailing is a service that consumers place orders on the online trading platform, and offline retailers within 3 ~ 5km around perform door-to-door delivery through third-party (or retailer-owned) logistics. The products provided include food and beverage, fresh fruits and vegetables, medical care, digital 3C and other commodities, and the delivery time is usually 30 ~ 60 minutes.

As a new retail model born with the rapid maturity of digital retail and instant delivery business, the biggest feature of instant retail is that it takes physical stores as the supply chain and relies on the instant delivery system to provide consumers with high convenience and high timeliness of home business to meet consumers’ emergency needs or immediate needs under normal conditions.

The main participants in this industry include retailers, brands, e-commerce platforms, and enterprises that undertake logistics and distribution services.

Instant retailing is divided into self-operated mode and platform mode. Comparatively speaking, the platform model is lighter, wider in use, richer in categories, and closely related to physical retail.

Different from traditional e-commerce represented by Tmall and JD.COM, and also different from emerging e-commerce such as social e-commerce and live e-commerce represented by Tik Tok, Pinduoduo and Xiaohongshu, instant e-commerce represented by Meituan, Hungry, JD.COM’s arrival at home and Taoxianda has strong timeliness, and point-to-point convenience services also put forward higher requirements for the service capabilities of platforms and businesses.

Different from catering takeout, instant retailing not only includes food catering, but also includes a large number of standard products, and the goods sold often have strong brand or retail channel brand attributes. If the extension of the concept of "take-away" is constantly broadened, instant retailing can also be regarded as a form of take-away that covers more industries and contents.

Different from retail in the same city, instant retail has stronger delivery timeliness and more limited delivery distance, and mainly relies on offline retailers within a certain range of consumers’ locations to meet users’ shopping needs.

Third, the development and present situation of instant retailing

In the era of accelerated penetration of the Internet, e-commerce and new retail formats have risen rapidly, which has had a great impact on traditional physical retail. However, offline entities always have irreplaceable advantages. With the increasing trend of online and offline integration, online to offline has won the favor of more and more enterprises by virtue of its advantages of opening up online and offline and improving the efficiency of traditional commercial operations. Giants such as Ali, Meituan, JD.COM and even SF have accelerated the layout of related tracks.

Focusing on retail entities and returning to the essence of the industry has also become the main development goal of encouraging the development of new consumption patterns and new formats and cultivating new retail in China in recent years. The Ministry of Commerce believes that instant retailing has effectively promoted the development of online services and localization of e-commerce.

In July 2022, the "Report on the Development of Online Retail Market in China in the First Half of 2022" issued by the Department of Electronic Commerce and Information Technology of the Ministry of Commerce clearly put forward the concept of "instant retail" for the first time, and said that online and offline channels tend to be deeply integrated, and new consumption scenarios such as instant retail, contactless consumption and live broadcast with goods will accelerate the layout and maintain the development momentum. On February 13th this year, Document No.1 of the Central Committee made it clear that in the course of "accelerating the development of modern rural service industry", it will "comprehensively promote the construction of county commercial system and vigorously develop new modes such as joint distribution and instant retail".

Although the concept was clearly put forward last year, the instant retail model existed several years ago. At the beginning, the business of home delivery was mainly concentrated in fresh e-commerce.

According to the "Report on the Development of Online Retail Market in China in 2022" released by the Department of Electronic Commerce and Information Technology of the Ministry of Commerce on February 20th this year, in recent years, instant retail services represented by fresh food, supermarkets and medicines have developed rapidly, and the proportion of all kinds of non-catering take-away business is expanding, and the take-away platform has also developed from a catering-based platform to a "everything delivered to home" platform. In terms of consumer demands, daily shopping is the mainstream appeal of consumers, and emergency shopping is most prominent in health categories, and demands such as "big promotion of buying", "early adopter buying" and "gift buying" are gradually emerging.

In recent years, consumers have begun to use "take-out" as express delivery, and more and more ways are used to solve daily consumption needs, such as take-out and flash purchase, which greatly cultivates users’ habit of "getting home" and puts instant retailing on the stage, making it stand out in the overall O2O market and become an engine that outperforms the general trend.

Coupled with the factors of joint efforts of government and enterprises, the O2O market with instant retail as the leader has expanded rapidly in recent years.

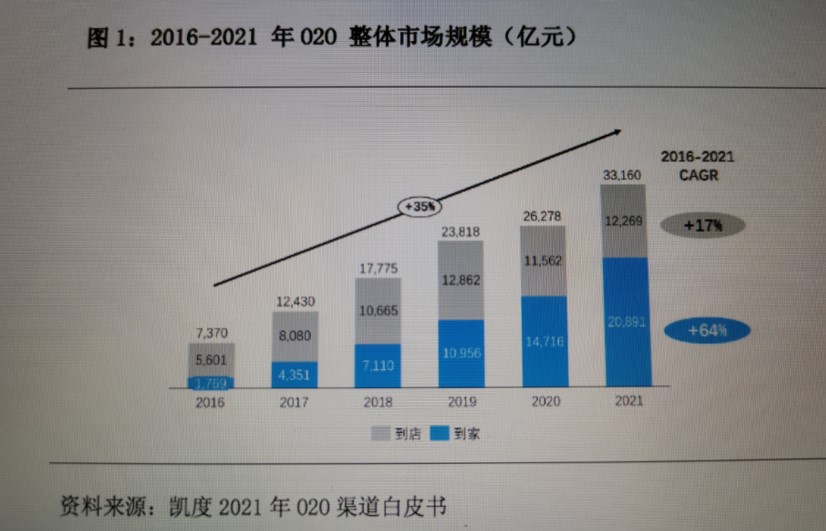

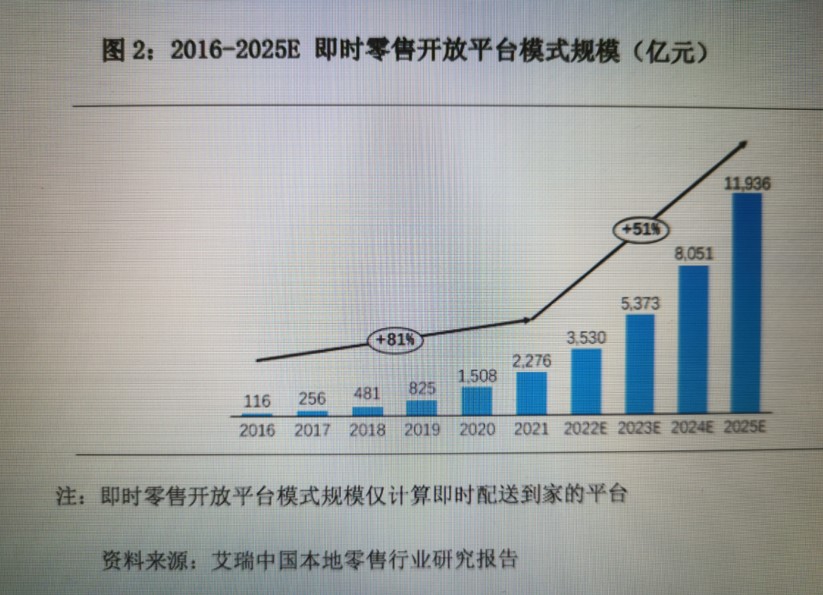

According to the White Paper on Instant Retail Open Platform Model published by China Chain Store & Franchise Association (hereinafter referred to as the White Paper), the overall market size of O2O exceeded 3.3 trillion yuan in 2021, of which the growth rate of home business in recent five years was 64%, which was the internal driving force for the growth of O2O market. As an important part of O2O home-to-home business, instant retail has grown significantly, with the market scale increasing by 81% in the past five years. It is expected that its contribution rate to O2O home-to-home business will continue to increase in the future, and it is expected to drive the growth of the overall market scale of O2O.

Focusing on O2O home delivery business, this cake with a market scale of more than 2 trillion in 2021 is mainly composed of two sub-businesses: catering take-out and instant retail. Due to the late start, instant retail accounts for a relatively low proportion. However, with the growth rate higher than the overall home-to-home business, the White Paper predicts that the compound growth rate of instant retail will continue to be high in the next few years. It is estimated that by 2026, the market size of instant retail will reach about 1.2 trillion yuan, becoming an important part of O2O home-to-home business.

IResearch also predicts that the order size of the instant delivery service industry in China is expected to be close to 100 billion in 2026, and the instant retail that has stood on the "window" will continue to maintain rapid growth, and it is expected to become the mainstream of the retail industry in China in the next 10 years.

Fourth, the main modes and players of instant retailing

In terms of business model, instant retailing is mainly divided into self-operated model and platform model.

Self-operated mode means that the merchants build their own stores or warehouses and online platforms, and at the same time have the ability of independent distribution, and are responsible for the whole chain management of goods. On behalf of enterprises, there are Boxma Xiansheng, Dingdong Shopping, Wal-Mart and Pupu Supermarket.

The platform mode means that the platform itself does not directly own the goods, but relies on the Internet platform to effectively link the online consumer demand with the offline stores, and the performing party provides instant delivery capacity services to deliver the goods in the stores to consumers. Representative enterprises include Meituan, JD.COM, Hungry, Taoxianda, etc.

Main players in platform mode:

(1) Meituan Flash Purchase

Meituan Flash Shopping is an instant retail platform under Meituan, which was officially released as an independent brand in 2018.

As a natural extension of the take-away business, Meituan Flash Shopping has gradually expanded from catering to supermarket convenience, specialty stores, drinks and snacks, fresh fruits and vegetables, green flowers, pet mothers and babies, digital books, daily cosmetics, household appliances and groceries.

In the past five years, from the first single non-food business to providing digital transformation solutions for brands and retailers, Meituan Flash Shopping has stood on the shoulder of Meituan Takeaway, and has also inherited its core resources — — 690 million young, high-quality users with strong growth and high consumption power, and a huge instant delivery network covering more than 2,800 urban counties and flags and with more than 5 million US group riders. This allows Meituan’s goods to be delivered in 30 minutes, which has strong "immediate" performance ability and distribution service advantages.

In 2020, Meituan piloted Meituan Lightning Warehouse in Beijing, Shanghai and other cities, which was similar to the pre-warehouse mode, focusing on daily consumption and fast-moving consumer goods, and basically did not sell fresh food. By the end of 2022, Meituan Lightning Warehouse has grown to more than 2,000, covering more than 180 cities across the country.

In 2021, the strategic adjustment of Meituan was upgraded from "Food+Platform" to "retail+technology", and the retail special group was led by Wang Xing himself, which showed the importance. In September 2021, Meituan held the "2021 Meituan Flash Shopping Digital Retail Conference" for the first time, announcing the launch of the "Billion Brand Growth Plan" for brand owners and the "Hundred Cities and Ten Thousand Stores Action" for chain stores. Meituan proposed that the retail market will enter the era of "Everything Now" from "Everything Store".

Since the second quarter of 2022, the strategic position of Meituan Flash Shopping has been greatly improved. The business statistics of financial reports are divided into core local businesses and new businesses, while Meituan Flash Shopping is divided into core local businesses from new businesses. According to the data as of June, 2022, the average daily order volume of Meituan’s flash purchase reached 4.3 million orders, and the peak daily order volume in Chinese Valentine’s Day last August reached 9.7 million orders, close to 10 million orders. Meituan’s financial report shows that in the second quarter of 2022, the number of Meituan’s instant delivery orders increased to 4.1 billion, and the quarterly revenue of core local commercial sectors including food and beverage takeout and Meituan’s flash purchase business increased to 36.8 billion yuan.

(2) JD.COM arrives home.

JD.COM Home is an instant retail brand owned by JD.COM, which was officially launched in 2015.

Relying on JD.COM App, JD.COM Home App and small programs, JD.COM joined hands with Dada Express Delivery and retail partners to provide consumers with an instant consumption service experience of supermarket convenience, fresh fruits and vegetables, mobile phone digital, medical health, home fashion, personal care and beauty, cakes, clothing, home appliances and other massive commodities delivered to their homes in about one hour.

On the supply side, JD.COM Home has successively cooperated with Yonghui Supermarket, Wal-Mart, CR Vanguard and other supermarkets in the past eight years, and merged with Dada to form Dada-JD.COM Home.

On the platform side, on October 11th, 2021, JD.COM released JD.COM Hourly Shopping, which fully integrated the advantages and resources of JD.COM Retail and JD.COM Home Shopping. Users bought goods with the logo of "Hourly Shopping" on JD.COM APP, which will be delivered directly from the surrounding stores 3 ~ 5km away and delivered within one hour. This is the collection of all the instant retail capabilities that can provide goods with hourly service in JD.COM ecological domain, which marks the realization of full LBS (Location-based Service) in JD.COM App and a key step in the layout of local retail in JD.COM. In 2022, JD.COM’s "hourly shopping" also opened the New Year Festival to ensure that the Spring Festival would not be closed.

Focusing on traffic empowerment, fulfillment empowerment, user empowerment, commodity empowerment and marketing empowerment, JD.COM Home provides online and offline integrated instant retail solutions for traditional retailers, and helps physical stores to have online fulfillment and refined operation capabilities, greatly improving floor efficiency and human efficiency, and achieving long-term online performance growth. Among them, in terms of traffic, JD.COM’s home and JD.COM’s dual-App operation opened the search portal for 590 million active users in JD.COM.

By the first quarter of 2022, JD.COM Daojia and JD.COM Hours Shopping had established cooperation with 86 of the top 100 supermarkets in China, covering more than 1,800 counties and cities in China, with over 200,000 offline active stores and serving over 75.4 million active consumers. According to the financial report for the fourth quarter and the whole year of 2022 released by Dada Group on March 9 this year, in 2022, the total transaction volume (GMV) of JD.COM Home Platform reached 63.3 billion yuan, up 47% year-on-year, and the number of active stores exceeded 220,000, up 50% year-on-year.

(3) Hungry

Hungry? It’s an instant retail platform owned by Alibaba.

At the beginning of its establishment in 2008, Hungry took "Everything 30min" as its mission, mainly engaged in online take-out, new retail, instant delivery and catering supply chain, which promoted the digitalization process of China catering industry. In 2018, it was wholly acquired by Alibaba and Ant Financial for $9.5 billion. Since then, hungry people have been fully integrated into the new retail strategy promoted by Alibaba, which has opened a new upgrade to expand the new retail of local life services.

On October 12, 2018, Alibaba announced the establishment of a local life service company to integrate Hungry with Word of Mouth. On June 17th, 2020, 100% of hungry people went online, and all business systems and database facilities were moved to Alibaba Cloud, supporting 100 million people to order online at the same time. On July 10th of the same year, when I was hungry, I announced that I had upgraded from a food and beverage take-out platform to a life service platform to solve all the immediate needs of users, and the service was upgraded from "take-out" to "send everything". Hungry brand advocates have changed from "good but not expensive, full of flavor" to "what you love, what you come for", and the food delivery service has been upgraded to all kinds of home service, including daily necessities, medicines, flowers, fresh food, running errands and many other consumer goods.

In the home business, if you are hungry, continue to focus on strategic cities to improve user retention and operational efficiency, and enhance the growth of non-meal delivery services. In recent years, if you are hungry, the joint merchants continue to upgrade the service standards in the real-time field, and launch several innovative services such as sunshine fruit cutting and melting, and are committed to consumers’ better realization of "rest assured and arrive on time" in a fast-paced life.

According to the 2022 blue rider Development and Security Report, 1.14 million riders will earn a stable income by being hungry in 2021. Hungry? According to the official website data, Hummingbirds have an average daily delivery order of 4.5 million, and the number of cooperative merchants has reached 3.5 million. The delivery service covers 2,000 large, medium and small cities and counties, and more than 3 million people have joined the ranks of Hummingbird Knights.

According to the Q3 financial report for the fiscal year 2023 (as of the end of December 2022) released by Alibaba, Ali’s local income was 13.164 billion yuan, up 6% year-on-year, and its operating loss was 5.473 billion yuan. The financial report shows that the overall order volume of Ali’s local life services in the current period increased flat year-on-year. Among them, the hungry home business continued to record positive GMV growth, the destination business was affected by the epidemic, and the overall order volume slowed down in December.

(4) Taoxianda

Taoxianda is an instant retail platform under the same city retail business group of Alibaba, which was officially launched in May 2017.

Different from the above three companies, Taoxianda initially positioned itself as "supermarket goods can reach every hour", realizing local supermarkets to settle in and consumers to shop at home for one hour. In recent years, Taoxianda has gradually extended from the supermarket category to more near-field demand categories, providing all-round near-field services covering supermarket categories, flowers and green plants, medicines, fresh fruit and fruit cutting, coffee and so on, and continuing to maintain the one-hour delivery time limit.

As a part of Alibaba’s new retail strategy, Amoy Star serves the traditional retail industry by helping businesses digitally transform their physical stores and providing online and offline integrated product solutions. At present, more than 30 physical retailers have settled in and more than 2,600 stores have been launched. They are committed to building a life consumption platform with good quality, good experience and good price, and provide multi-layer performance services for nearly 240 cities across the country with one-hour delivery and half-day delivery. By 2022, Taoxianda has accumulated 200 cooperative brands, basically achieving the brand coverage of the standard category.

Taoxianda takes the homepage of mobile phone Taobao as the main online entrance, and at the same time carries out multi-position operation of mobile phone Taobao, Alipay, mobile phone Tmall, and Ali ecological global link, linking traditional large supermarkets, flower shops, drug chains, fruit chains and convenience store chains within 3-5 kilometers for consumers of billions of scales. Based on Taobao’s powerful digital ability, it ensures a richer choice of product width. Taoxianda helps consumers place orders anytime and anywhere through mobile phone Taobao, and purchase all the needs of daily life in one stop. At present, Taoxianda is provided with delivery service by hummingbirds.

V. Comparison between the two modes

The two modes of instant retail have their own advantages and disadvantages, but from the perspective of their business attributes, the open platform mode has attracted more attention from the outside world and is regarded as the main market with fierce competition in the future.

(1) Platform mode

Because the platform model does not own goods directly and does not need to invest heavily in laying offline stores, it takes up less capital, and belongs to the model of asset-light strategy, which is more conducive to the rapid expansion of the market, and also helps to focus on online traffic operation and the improvement of logistics distribution capacity.

Compared with the self-operated mode, by continuously expanding the types, scope and quantity of settled businesses, the integrated products will be richer in categories, often covering all categories such as grain, oil and non-staple food, snack food, fresh fruits and vegetables, mobile phone digital, medicine and health, personal beauty care, flowers, cakes, clothing, home and small household appliances, which can meet the instant consumption needs of consumers.

As far as traffic is concerned, the platform model mainly relies on the entrance of the Internet platform. Because the digital gene has a strong traffic resource base and operational ability, it can bring new traffic to many offline retailers and brands, help offline entities reach the surrounding consumers more efficiently, and provide a complete set of digital solutions for online and offline integration.

The revenue of the platform model mainly comes from the service fee of the platform, and profits are realized through the scale effect generated by the platform.

(2) Self-operated mode

The self-operated mode mainly sells products directly owned and operated by the merchants themselves, so it needs to purchase, invest money to build a large number of pre-warehouses or stores online, and train teams to complete all links such as sorting, distribution, and management and operation of commodity inventory, so it needs a large cost investment and belongs to a typical heavy asset operation. Most of the self-operated models are vertical fresh e-commerce or large-scale offline supermarkets. This operating model requires enterprises to have high profitability and business expansion capabilities, otherwise they will easily fall into a state of loss.

Compared with the platform model, the self-operated model not only has higher cost, but also has lower variety and brand richness. On the one hand, it is necessary to purchase or customize production from brands or suppliers, and on the other hand, it is necessary to ensure the efficiency of performance. Because we have to take care of all links from procurement, operation to sorting and distribution, the expansion space is smaller than that of the platform model, but the overall management and control are relatively centralized.

The self-operated mode is similar to the profit mode of traditional stores. The income mainly comes from the difference between the purchase and sale of goods, and the circulation efficiency of goods is improved through automation, digitization and other ways, thus increasing profits.

Vi. Major Players’ Dynamics in 2023

Instant retail stations are popular, attracting a lot of players. Prior to this, Baidu take-out and Didi take-out had been laid out, but in the end they all chose to leave for different reasons. Recently, Internet giants such as Tik Tok and WeChat have been reported to enter the take-away business one after another, hoping to get a slice of instant retail. It is certain that while the market structure is taking shape, the competition in this field will become more and more fierce.

Then, in 2023, when the economy is accelerating recovery, what actions will the main players take?

(1) Meituan Flash

As an important part of Meituan’s instant retail, Meituan’s pre-warehouse e-commerce business, Meituan’s grocery shopping, will become one of the focuses of this year’s efforts.

In February this year, Suzhou Kaesong plan, which was put on hold at the beginning of last year, was restarted, and the site selection has been completed locally, and it will be opened in the near future. In addition, Meituan will go to more East China cities to start a new round of expansion plans on the premise of ensuring breakeven this year. At present, Meituan has more than 500 pre-positions for grocery shopping, and the average daily order quantity is stable at more than 1.1 million.

At the same time of expansion, Meituan is also strengthening in-depth cooperation with more leading brands to promote the joint business plan of merchant brands. For example, in February this year, it signed a joint business plan for 2023 with Yili, and announced that it would cooperate deeply in the Internet retail field of a full range of products such as fresh milk, yogurt and ice cream. The two sides will fully cooperate in new product launch, Internet brand marketing and supply chain optimization to continuously optimize the consumer experience.

As one of the instant retail platforms with the largest number of riders, Meituan will continue to increase investment in riders this year to ensure the efficiency of performance and service quality. At the beginning of this year, Meituan launched the "Spring Breeze Sending Jobs" campaign in 2023, and launched six major measures, which not only opened 500,000 rider posts, but also launched live recruitment and special recruitment, expanded the employment opportunities of part-time riders, and developed exclusive functions for key groups, and continuously improved the "novice system" and channels for promotion, job transfer and academic upgrading to attract and retain talents. On February 13th, Meituan Flash Delivery also announced the measures to optimize the orders for large items, and optimized the delivery rules for "large-volume, large-weight and high-price" orders such as flowers, beauty cosmetics and mobile phones, so that riders can get large-order delivery subsidies in special scenes.

In addition, it is reported that Meituan Consumer Finance will be established in 2023, which indicates that Meituan will use financial technology to empower instant retailing.

(2) JD.COM arrives home.

For JD.COM to get home, it is the key direction in 2023 to continue to expand the coverage of joint brands and businesses, and make efforts to sell high-frequency repurchased products such as fresh food and vegetables, and further give play to the advantages of digital intelligence to improve the performance efficiency.

In the first quarter of this year, JD.COM signed a new contract with chain stores such as Good Sale and Convenience Bee, and has cooperated with 90% of the top 100 supermarkets. At the same time, it also newly signed fresh brands such as Jiawo, dairy brands such as Uno, and wine brands such as Jiang Xiaobai, and continued to increase instant retail.

In February, it was also reported that JD.COM was testing the "JD.COM Shopping" project in a low-key way, and the possibility of independent channels, apps, etc. was not ruled out. The news has not been officially confirmed, but JD.COM, which is good at low-frequency products such as 3C digital, hopes to further strengthen the business attributes of fresh food and food shopping in JD.COM in instant retail brands, and it is undoubtedly a high probability trend to increase the sales of high-frequency products. In fact, constantly expanding categories and scenarios to attract as many consumers as possible is also the direction of all instant retail platforms.

In terms of shopping convenience and performance service, JD.COM will continue to give full play to the advantages of omni-channel layout and digital intelligent supply chain when he gets home, and further improve the performance efficiency of brand owners and physical stores. In March this year, JD.COM signed a strategic cooperation agreement with Xiaotiancai, a smart wear brand. Focusing on the "hourly purchase" business, all parties will cooperate in many aspects, such as commodity management, omni-channel digital marketing, refined operation of users, and optimization of performance efficiency, so as to jointly create an ecological closed loop of instant consumption of e-education categories, enhance consumers’ instant retail experience, and explore new growth in the instant retail market. By March, 2023, the number of stores that Xiaotiancai cooperated with JD.COM Hourly Shopping has exceeded 5,000, and the goal is to achieve the online hourly shopping business in JD.COM with over 6,000 stores by the end of 2023.

(3) Hungry

In 2023, hungry people who started from food and beverage take-out will continue to consolidate their advantages and help the food and beverage brands to grow further through various measures in four dimensions: content marketing, product building, event marketing and omni-channel shelves.

In addition, if you are hungry, you plan to take the word "Jin" as the first step this year. On the basis of undertaking 30 municipal government coupon projects in 2022, you will further promote the integration of data and reality and promote new forms of employment.

For physical stores, if you are hungry, you are committed to helping businesses to take the "three small steps" of integration of numbers and reality: taking the first step on the platform for businesses with caring service, promoting businesses’ single-volume business with creative marketing, and driving businesses’ consumption innovation with scene creation.

In terms of performance services, the promises of "rest assured" and "on time" will continue to be fulfilled. At the same time, we will continue to strengthen the protection of riders, continue to optimize the "rider growth and development system", and serve the development of riders in an all-round, full-coverage and whole-process manner, so that more workers can truly feel that flexible employment can become a long-term career.

At present, Alibaba’s local business sector with the strategic framework of "home+destination" has gone hand in hand in the past, and has made certain progress as a whole. Among them, the progress of being hungry is remarkable — — Due to the continuous improvement of economic benefits per unit and the increase of average order value year by year, the loss of Ali Life Service Plate accelerated and narrowed due to the continuous improvement of business operations. This trend is expected to continue this year.

(4) Taoxianda

From the taste of the year to the flowers and rain gear for Valentine’s Day, and then to the one-hour service of the "licensed photo suit", a series of actions of Amoy Xianda are highlighted this year. This instant retail platform, which was originally positioned as "supermarket goods can reach the hour", is moving towards a more comprehensive product category and more service scenarios, and is constantly breaking through in performance efficiency.

In February this year, the first batch of flower shops in Hangzhou settled in Taoxianda, and the service was delivered within five kilometers around the store within one hour. Considering that Valentine’s Day on February 14th is also the wedding peak, Taoxianda also launched a "licensed photo suit". Consumers can enter Taoxianda through Taobao’s homepage, and place an order with one button, including a product set with flowers, veil and swastika, which will be delivered to the photo scene in one hour. In addition, Taoxianda is also accelerating access to more local businesses, such as reaching a strategic cooperation with the flagship store of adult stores, further increasing the convenience of consumers’ shopping and the timeliness of arrival.

At the beginning of this year, it was reported that Tmall was planning an "hourly shopping" business, which was called the retail version of Hungry. Liu Peng, Alibaba’s vice president and president of Alibaba’s B2C retail business group, took the first position and is currently building a business team. However, the relevant person in charge replied that "Hours Reach" means "Amoy Fresh Reach", and consumers can click "Amoy Fresh Reach" on the homepage of Taobao App to experience the one-hour express delivery service of fresh fruits and vegetables, rice flour, grain and oil, daily necessities and other commodities. It seems that Ali, who already has a hungry horse and a box horse, will pay more attention to the investment of Amoy Fresh, thus forming three instant retail business lines to accelerate the opening of the situation.

Seven, instant retail development trend

The extension and expansion from food and beverage take-out and supermarket delivery to more retail scenes will be the development trend of instant retail, thus showing the characteristics of wider customer base, more scenes and more comprehensive demands on the consumer side, while showing the advantages of more comprehensive products, more brands and wider regions on the supply side.

As far as the consumer side is concerned, the extension of more retail scenes, such as the consumption expansion from a single home to hotels, administrative institutions and other scenes, will inevitably meet the more diverse demands of more customers, and accelerate the demand expansion from "daily purchase" and "emergency purchase" to "big promotion purchase", "early adopter purchase" and "gift purchase" and so on. In terms of coverage, it will accelerate its penetration from first-and second-tier cities to cities and villages in the third and fourth lines and below.

The improvement of consumer demand needs the upgrading of the supply side, and it will also drive the changes of the supply side.

Looking back, the initial instant retailing was mainly catering, food and beverage and fresh products, but in the process of development, it gradually extended to more categories such as mobile phone digital, medical health, personal beauty care, flowers, clothing, home and small household appliances. In the future, it will expand from leading brands to more brands, and more regional specialty products are expected to be included in the field of instant retailing, expanding sales channels and better meeting the needs of consumers.

From the platform side, the platform will continue to deepen the operation of traffic and the performance of services, thus continuously improving the traffic and service empowerment for retailers and brands.

Among them, in terms of traffic operation, the future instant retail open platform will evolve into a cooperative and open platform, which will gather not only the traffic portal of the platform itself, but also more retail scene traffic including content e-commerce and live broadcast.

In terms of performance services, the platform will continue to break through on the basis of the current hourly experience, and achieve minute-level, even faster and smarter performance efficiency by introducing more unmanned intelligent technologies. At present, the performance service of basic commodities will be further extended to product-related peripheral services, and financial technology elements such as consumer finance will be integrated to improve the innovation and attractiveness of services.

In terms of empowering retailers and brands, the platform is currently mainly based on big data to help retailers and brands to carry out omni-channel marketing promotion, provide marketing decision-making assistance to continuously optimize marketing strategies, and at the same time operate the full link for instant retail stores to help traditional retailers realize digital transformation, so as to improve the operational efficiency of stores and thus enhance the consumption experience. In the future, such empowerment will expand from marketing and store operation to a longer chain and a more complete product cycle such as supply chain management, helping traditional retailers and brands to provide the ultimate service that matches the needs of consumers in time in the evolution of C2M (Customer-to-Manufacturer).

关于作者