In 2023, the state subsidy policy for new energy vehicles of up to 10,000 yuan was officially withdrawn. According to the Notice on the Financial Subsidy Policy for the Promotion and Application of New Energy Vehicles in 2022 issued by the Ministry of Finance and other four departments, the national subsidy policy for the purchase of new energy vehicles will be terminated on December 31, 2022, after which the new energy vehicles will no longer be subsidized.

In 2022, the state subsidy policy stipulated that the subsidy for plug-in hybrid vehicles was 4,800 yuan, new energy vehicles with a battery life of 300 -400 kilometers could enjoy a subsidy of 9,100 yuan, and pure electric vehicles with a battery life of over 400 kilometers received a subsidy of 12,600 yuan. After the withdrawal of the state subsidy, these corresponding subsidies disappeared.

According to the industry forecast, the withdrawal of the State Compensation Fund will have a limited impact on the overall sales growth of the new energy vehicle market, but it will overdraw the demand for new energy vehicles in the first quarter of 2023 to a certain extent, and at the same time, it will also put those enterprises that lack product competitiveness in a dilemma, and the market competition will become more intense.

Car companies respond to the withdrawal of the country.

After the withdrawal of the state subsidy policy, the cost of new energy vehicles has increased by about 10 thousand yuan, and whether this part of the cost will be borne by car companies or passed on to consumers has become the focus of market attention.

As a result, we have seen car companies launch a variety of strategies to cope with the country’s withdrawal. Some car companies directly announced price increases, but also made high-profile promises not to raise prices, and even chose to stay put and observe the market trend, and launched limited-time promotional activities without raising prices.

It can be seen that car companies have given different feedbacks to the withdrawal of state compensation, and the withdrawal of state compensation has also directly affected consumers’ willingness to buy cars. There are also many disputes in the industry about the trend of China auto market in 2023.

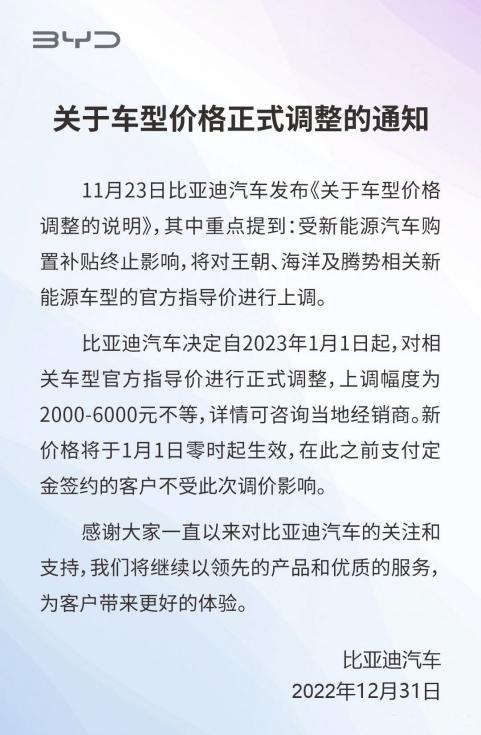

BYD was the first new energy vehicle company to announce the price increase. As early as the end of November last year, BYD issued the "Explanation on Vehicle Price Adjustment", announcing that it would adjust the official guide price of its Dynasty, Ocean and Tengshi new energy vehicles on January 1, 2023, with the increase range ranging from 2,000 yuan to 6,000 yuan.

BYD said that the price adjustment is related to the withdrawal of new energy vehicles, and of course there are reasons for the price increase of power batteries. On the last day of 2022, BYD issued a notice again to confirm the official price increase.

In addition to BYD, some car companies have also announced that they will start raising prices for their new cars in 2023. Among them, GAC Ai ‘an issued a statement saying that the official guide price of its related models will be raised from January 1, with an increase range of 3,000-8,000 yuan; Subsequently, Changan Deep Blue also announced that it is expected to increase the price of Changan by 2,000-8,000 yuan in 2023, and officially confirmed that the price will increase by 3,000-6,000 yuan after January 1, which increased the price increase of entry-level models and reduced the price increase of high-profile models.

In addition, in addition to the above car companies announced price increases, Volkswagen ID. Series, Chery Ant Series, Roewe and other models have all raised the price of new cars at the beginning of this month.

However, judging from the price increase of new cars, the price increase of most models is concentrated in the price range of 2,000-8,000 yuan. Car companies have not completely passed on the 10,000 yuan subsidy they withdrew to the consumer, but have chosen to bear part of it themselves. This is also a sign of leaving some room in the highly competitive market. After all, the price increase will have a great impact on sales for many car companies.

In addition to the price increase faction, there are also many car companies that choose to extend the "insurance policy" for a limited time in order to ensure sales, and announce that they will not raise prices in a high-profile manner. Among them, Tesla did not announce the price increase, but also introduced a limited-time preferential policy. For customers who purchased Model 3 and Model Y from January 1 to February 28 and completed the delivery, they could enjoy a limited-time delivery incentive of 6,000 yuan; At the same time, you can also enjoy a time-limited insurance subsidy of 4,000 yuan on the basis of 6,000 yuan, and the comprehensive discount is as high as 10,000 yuan.

In addition, SAIC-GM-Wuling officially announced that its new energy models, series and KiWi EV will continue to refer to the guidance price in 2022, and all orders that pay the deposit before January 31, 2023 (inclusive) can enjoy the insured service, which is not affected by the national subsidy. Users can still pay according to the guidance price when placing the lock order.

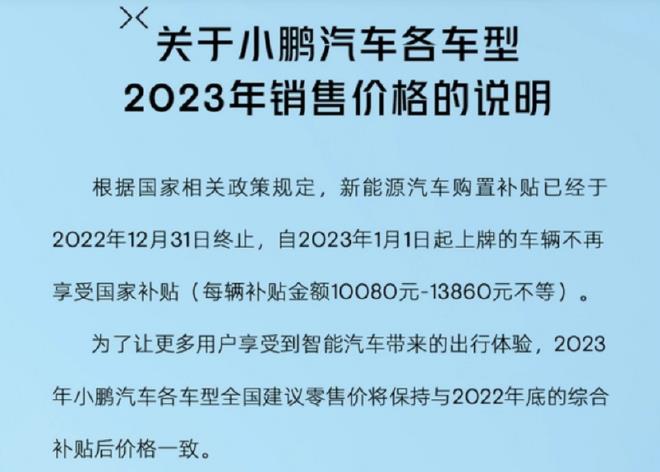

Unlike Tesla and SAIC-GM-Wuling, many car companies firmly adhere to the principle of no price increase for some of their models. Among them, Xpeng Motors announced that it will not increase the price in 2023 with the withdrawal of new energy vehicles.

According to the announcement issued by Tucki, according to the relevant national policies and regulations, the subsidy for the purchase of new energy vehicles has been terminated on December 31, 2022, and since January 1, 2023, the licensed vehicles no longer enjoy the state subsidy (the amount of each subsidy ranges from 10,080 yuan to 13,860 yuan). In 2023, the national suggested retail price of various models in Xpeng Motors will remain the same as the comprehensive subsidized price at the end of 2022.

In addition, Zero Run Auto also announced that its zero run C01 model will not increase in price, and Wei Brand, a subsidiary of Great Wall Motor, recently announced that its price will not increase temporarily. These enterprises all indicated that they will continue to extend the price of the national subsidy promotion in 2022 and implement the vehicle concessions to the end.

Of course, in addition to the two attitudes of price increase and price protection, some car companies have not adjusted the price, mainly waiting to see the specific trends of peers and the market.

Needless to say, BYD doesn’t worry about orders, even if the price increases, there are consumers queuing to buy. Guangzhou Automobile Ai ‘an, Chang ‘an Deep Blue, Geely Ruilan and other car companies also have strong competitiveness in the new energy vehicle market, and the price increase will not have a great impact on car companies.

For Tesla’s preferential promotion, in fact, a large part of the reason is related to the fact that the sales volume in 2022 did not meet the market expectations. Tesla wants to exchange the price. After all, its bicycle profit is high and the profit margin is relatively larger. At present, the most important thing is to increase the delivery volume to alleviate the current embarrassing situation.

The fundamental reason for those brands that have announced that they will not raise prices temporarily is related to the recent high sales pressure. For example, Tucki’s sales performance in October and November was not bright, and it was not until December that it returned to the 10,000-vehicle camp; And the zero-run has sold less than 10,000 vehicles for several months in a row, and the sales of Wei brand’s models are not very good. The insurance price is mainly to enhance the competitiveness of products.

In this regard, Zhang Xiang, dean of the New Energy Automobile Technology Research Institute of Jiangxi New Energy Technology Vocational College, said that the first quarter of the calendar year is the off-season of automobile consumption, and many consumers who have car demand choose to buy cars at the end of the year, and the market has formed a phenomenon of "oversupply". Therefore, some brands will choose not to raise prices after the withdrawal of the state subsidy.

Regarding whether new energy vehicles will face a large-scale price increase after the withdrawal of State Compensation, industry experts said that because the demand for new energy vehicles is a long-term release demand, the current market competition pattern has changed, so car companies still want to exchange prices for quantity, market share and sales volume are the most important at present, so it is not expected to raise prices on a large scale after the cancellation of State Compensation.

There are many kinds of people in the auto market before and after the exit of the state compensation

Under the influence of factors such as the end-of-year impulse superposition and the imminent withdrawal of "national compensation", the terminal automobile market presents a lot of people. In fact, before and after the withdrawal of the new energy state subsidy, the changes in the new energy vehicle market are still very obvious.

As early as the beginning of December last year, new energy vehicles began to usher in a wave of sales boom, mainly because those consumers who want to buy new energy vehicles have to enjoy the last benefits before the withdrawal of the state subsidy.

Before the end of 2022, an extremely successful car salesman said that due to the coming end of the state subsidy, the number of customers coming to the store to see cars has increased significantly recently, and the order volume has also increased.

The sales staff of BYD’s 4S store also threw an olive branch to the users who came to see the cars, and said: The customers who were interested in buying cars before basically completed the car booking before the end of 2022, and the best sales result was that they sold 100 new cars in three days, and many buyers wanted to catch the last preferential bus before the exit of the national subsidy policy.

In the circle of friends of Tesla staff, we also saw the slogan "Save 30,000 yuan by the end of 2022". In the past month, Tesla frequently brushed promotional information, and various fancy price reduction promotions attracted potential consumers to place orders.

"Today, the subsidy is terminated. Now it is the peak of car purchase. There are existing cars in individual configuration stores. You can order the input system first and lock the price." On the last day of 2022, a staff member of Guangzhou Automobile Ai ‘an urged the users who came to see the car to place an order, and said that the number of intentional customers who saw the car and made an inquiry recently increased significantly.

Although some car companies have not made great efforts to promote sales, due to the coming end of the state subsidy, the orders of some brand stores have increased significantly recently, and many consumers want to catch the last bus of subsidies.

Standing at the crossroads before the withdrawal of the state compensation, car companies frequently resorted to "fancy marketing" such as price increase, price reduction and price limit, which made the car market crowded at the end of 2022.

Whether car companies plan to raise prices after the year or launch various preferential activities before the year, in a certain sense, they will play a positive role in promoting the sales of new energy vehicles at the end of the year.

Judging from the estimated wholesale sales volume of 730,000 new energy passenger cars in December, it increased by about 0.4% from November and by about 45% compared with last December. The sales growth is inseparable from the credit of the country’s exit.

Judging from the car companies that have announced their sales in December, the monthly sales of many car companies have doubled year-on-year or reached a record high because the withdrawal of state subsidies has stimulated early consumption.

Take BYD as an example. In December last year, it sold 235,200 new cars, which exceeded 200,000 for four consecutive months. Last year, the cumulative sales volume was 1,863,500 vehicles, a year-on-year increase of 208.64%.

In addition to BYD, car companies such as GAC Ai ‘an and Sailis also handed in good transcripts. Among them, the monthly sales volume of GAC Ai ‘an was 30,000 units, a year-on-year increase of 107%; The monthly sales volume of Sailisi new energy vehicles was 16,643 vehicles, up 170.62% year-on-year.

At the same time, Wei Xiaoli, a new car-making force, also achieved good results in December last year. Weilai delivered 15,815 new cars, a record monthly delivery, with a year-on-year increase of 50.8%; LI delivered a total of 21,233 new cars, once again setting a record for the highest delivery in a single month, with a year-on-year increase of 50.7%; Xpeng Motors also returned to ten thousand clubs and delivered 11,292 new cars, up 94% from the previous month.

Compared with the crowded stores of auto companies before the end of December last year, many new energy vehicle sales stores were slightly deserted in the first month after the withdrawal of the state compensation.

A new energy salesperson said that since most new energy vehicles began to increase in price on January 1, many users rushed to place orders before the end of last year, so there are fewer people watching cars now.

It can be seen that with the withdrawal of the state compensation, the new energy vehicle market is facing intensified competition. In order to further boost consumer confidence in the market, many cities have recently announced the issuance of a new round of automobile coupons.

For example, Zhengzhou City’s "Spring Festival in the Year of the Rabbit" 50 million yuan car coupons were issued on January 5, of which 20 million yuan were issued for new energy vehicles; During the period from January 1 to March 31, 2023, Jinan will issue a total of 10 million yuan of automobile coupons in three rounds.

The pressure on the auto market will enter an adjustment period in the first half of the year.

Because some users chose to buy cars in advance at the end of last year in order to grab the national bonus, and the first quarter was also the off-season of automobile sales, this made the domestic automobile market under pressure to some extent in the first quarter of this year.

Previously, Li Bin, chairman of Weilai, once said that in the first half of 2023, the domestic new energy auto market will have a period of pressure, and it is expected that the market will gradually recover from May next year.

Cui Dongshu, Secretary-General of the National Passenger Car Market Information Association, also believes that the automobile market may be in a downturn in the first half of 2023 and enter a short adjustment period, and this situation is already a sign.

According to the data of the Passenger Car Association, the retail sales of China passenger car market in November 2022 was 1.649 million vehicles, down 9.2% year-on-year and 10.5% month-on-month. This is the first time since 2008 that the "Golden September, Silver, Ten Bronzes and Eleven" features a month-on-month decline, among which the conventional fuel car market is under great pressure.

From the historical data, subsidies can push up sales, and the withdrawal of subsidies often leads to a sharp decline in sales in a short period of time. However, Cui Dongshu believes that although the policy of state subsidy has been withdrawn, there are still many policy supports in the whole new energy vehicle market, such as road rights support, purchase right support and vehicle purchase tax reduction, etc., and the overall impact of new energy vehicles is not significant.

Cui Dongshu also gave his own opinion on whether the withdrawal of subsidies will cause the new energy auto market to get cold. He believes that a core of the development of new energy vehicles this year is the substantial improvement of product strength and the improvement of enterprise innovation ability.

For example, BYD’s growth has contributed a huge increase to the market, and the entry-level car market such as Wuling Hongguang MINIEV has also achieved a large increase. The new energy vehicle market is mainly driven by market demand.

This judgment can also be reflected in the sales terminal. One user said that if you just need a car, you will buy it even if there is no subsidy. After all, the new energy vehicles have made great progress now, and all aspects of the expenses are relatively economical.

Based on the rapid development of new energy vehicles in China, the Association predicts that the wholesale sales of new energy passenger cars in China will reach 8.4 million in 2023, with a year-on-year increase of more than 30%; The China Automobile Association also predicts that the cumulative sales volume of new energy vehicles in China will be 9 million in 2023, a year-on-year increase of 35%.

But then again, after the withdrawal of the state compensation, it will definitely have an impact on many new energy vehicle companies, especially the new forces that build cars. At present, BYD is the only domestic new energy vehicle company that has achieved profitability. From the financial report of the first three quarters of 2022, the net profit of returning to the mother reached 9.311 billion yuan.

Compared with BYD, which earns a lot of money, most new energy car companies are still at a loss. The data shows that in 2022, the total net loss of Weilai in the first three quarters was 8.712 billion yuan; The total net loss of Tucki in the first three quarters was 6.778 billion; Even with the ideal of strictly controlling costs, the total net loss in the first three quarters reached 651 million. And this is just a "Wei Xiaoli" who is regarded as the head of the new power, and those new power brands in the second and third lines will become more difficult.

Take Weimar Automobile as an example. In 2022, the prospectus on the Hong Kong Stock Exchange became invalid, and then it was rumored that it would be acquired. Previously, it also experienced many storms such as salary reduction, layoffs and store closure. Obviously, Weimar’s future is bleak without capital support and the withdrawal of the state compensation.

In fact, Weimar is just a microcosm of the new car-making forces. In 2022, there were many problems such as the bankruptcy and liquidation of Lvchi Automobile, the exposure of Hengchi’s work stoppage and unpaid wages, and the inability of self-travelers to deliver. Some new forces that were not paid attention to also faced severe tests.

Subsidy withdrawal not only makes car companies face the test of life and death, but also has a certain impact on the product structure of new energy car companies. The withdrawal of the state subsidy has a more obvious impact on pure electric vehicles with a price of less than 100,000 yuan. After all, consumers who buy this price range are more sensitive to the price, and the models in this price range are products with relatively low profits for car companies. If the price increases, customers will be lost, and car companies will have to pay for themselves.

Obviously, in the era of non-subsidy, the stronger the new energy vehicle track, the more obvious it will be. Those large-scale enterprises have inherent advantages in reducing costs, and the high profits of high-end models can better share the losses of low-priced models, so many car companies choose to improve their product matrix to enhance their competitiveness.

However, due to the withdrawal of state subsidies, the wave of price increases and the impact of the Spring Festival, it is inevitable that automobile consumption will be under certain pressure in early 2023. How to continue to tap and release the potential of automobile consumption in 2023 and strive to achieve positive growth has become the focus of the industry.

Summary: The withdrawal of the state subsidy means that new energy vehicles are gradually maturing, no longer relying on the promotion of subsidy policies, and completely turning to market-driven. It can be predicted that in 2023, a brand-new competition of survival of the fittest will be launched soon, and the competition among new energy vehicle companies will become more intense.

关于作者